Software as a Service (SaaS) continues to grow as one of the most dominant forces in the tech industry.

Thousands of companies are building and scaling through SaaS, changing how businesses operate, communicate, and deliver value.

With that in mind, let’s explore the number of SaaS companies stats, covering startup growth, market share, regional data, business spend, and what the future holds.

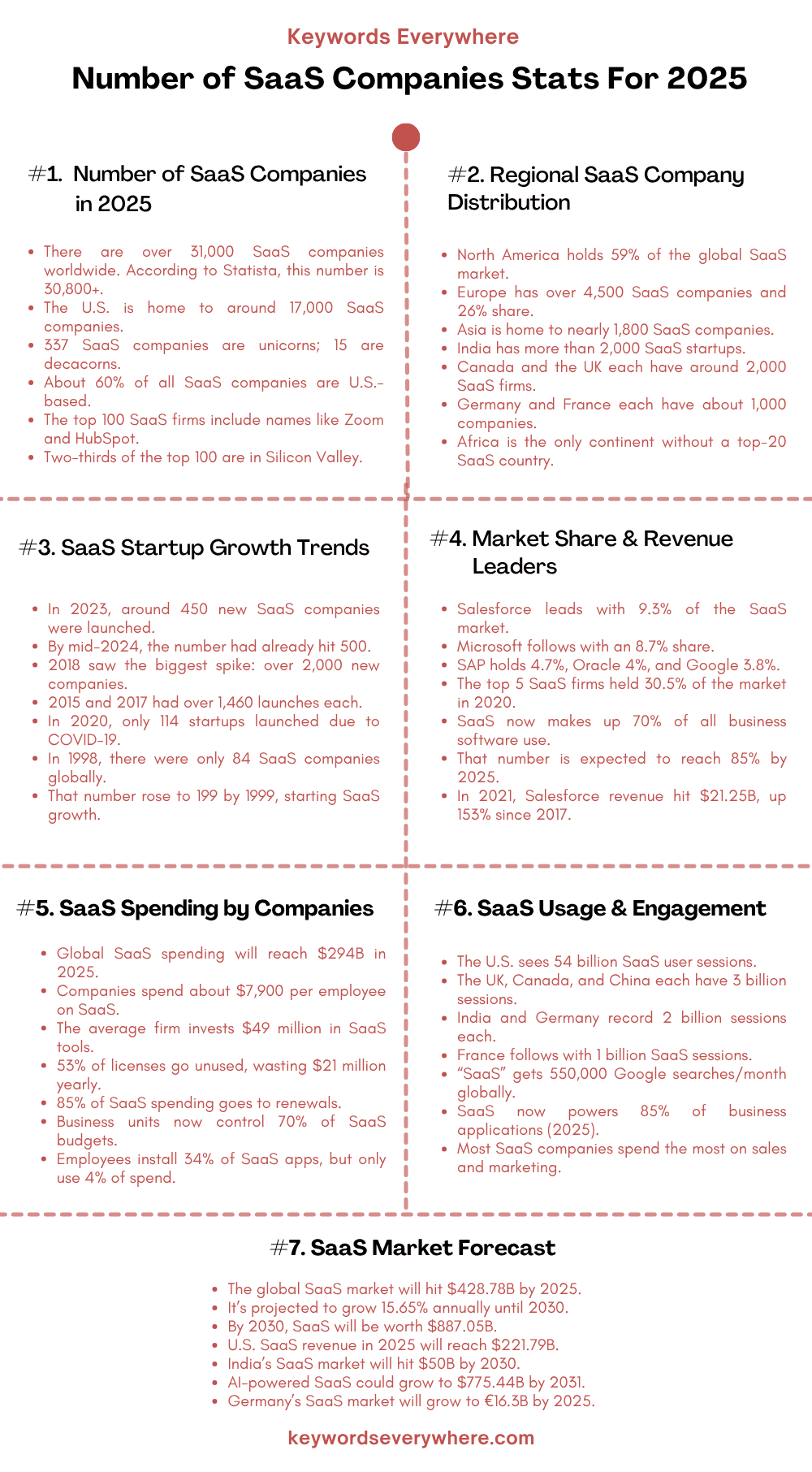

Number of SaaS Companies Stats (Top Picks)

The SaaS market continues to grow every year, with more companies entering the space and customers relying heavily on cloud-based tools.

From total company count to startup trends and market revenue, the numbers tell a clear story of fast-paced industry expansion.

Here are the number of SaaS companies stats that highlight the key takeaways at a glance:

1. There are now over 31,000 SaaS companies around the world—and that number keeps growing every year.

2. The United States leads the way, with about 60% of all SaaS companies based there.

3. By 2030, the global SaaS market is expected to reach nearly $900 billion, showing just how big this industry is becoming.

Global SaaS Market

4. Germany is currently the fastest-growing SaaS market in Europe, with more startups and enterprise tools launching each year.

5. If you count repeat users, the U.S. sees around 54 billion SaaS user sessions.

6. Salesforce holds the biggest share of the SaaS market, owning just under 10% of it on its own.

7. For most SaaS businesses, sales and marketing take up the largest portion of the budget, more than any other area.

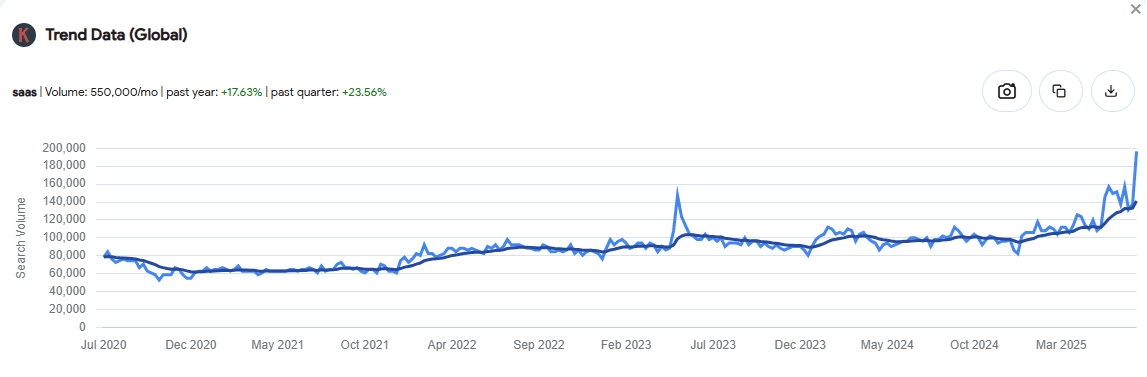

8. According to Keywords Everywhere, the term “SaaS” gets searched about 550,000 times every month on Google, and interest in it has steadily grown over the past five years.

How Many SaaS Companies Are There in 2025?

The total number of SaaS companies around the world keeps increasing year after year as demand for digital tools continues to rise.

From major software vendors to small niche platforms, SaaS is a space that’s become essential to how businesses operate.

Here are the number of SaaS companies stats that show how many exist in 2025:

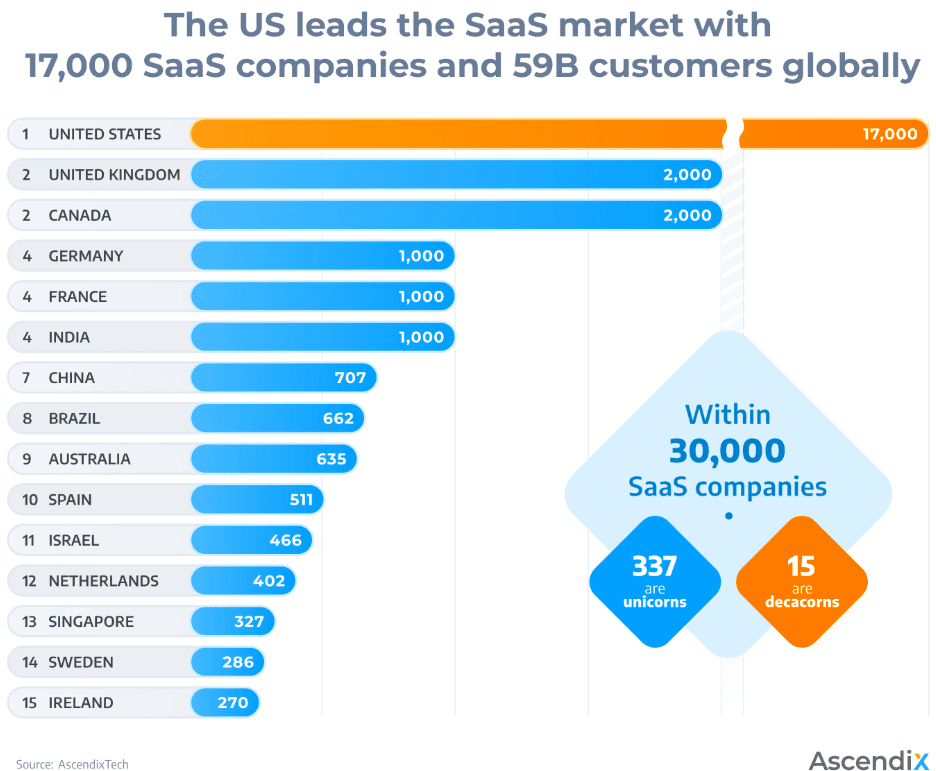

9. There are now over 30,800 SaaS companies worldwide, with the majority based in the United States, according to a report by Statista.

Total SaaS companies worldwide in 2025

10. Some of the biggest U.S.-based SaaS names include Google Workspace, HubSpot, Slack, GitHub, Zoom, and Figma.

11. About two-thirds of the top 100 SaaS companies are located in Silicon Valley, making it a major hub for the industry.

12. Out of those 30,000+ companies, 337 are unicorns (valued at over $1 billion), and 15 are decacorns (worth over $10 billion).

13. A forecast by Ascendix says the number of SaaS companies could reach 72,000 by 2025—and if you include AI companies, that number could jump to 175,000 globally.

14. The U.S. alone has around 17,000 SaaS companies, and together they serve about 59 million customers around the world.

15. The UK and Canada follow with about 2,000 SaaS companies each, while Germany and France have around 1,000 each.

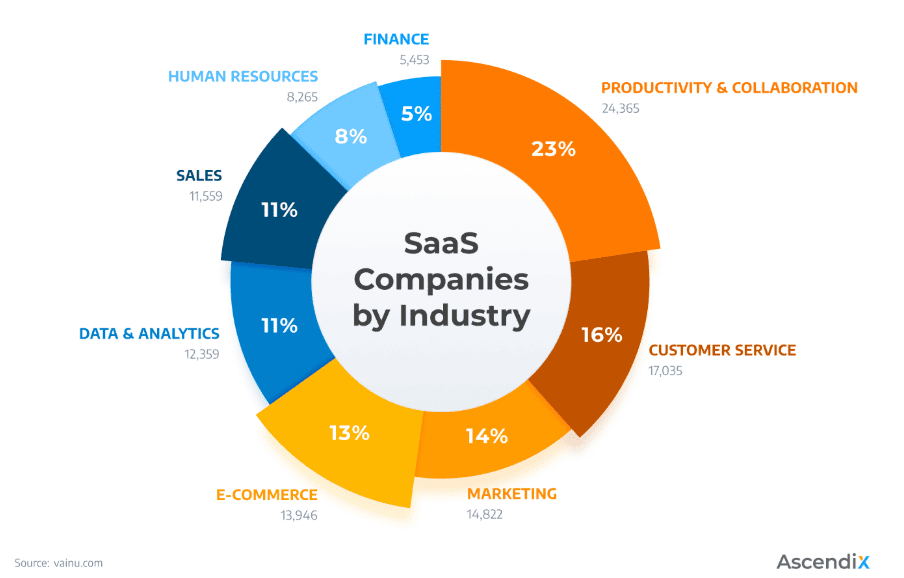

16. In terms of software categories, there are 17,000 SaaS companies focused on customer service, 15,000 in marketing, 14,000 in eCommerce, 12,000 in data and analytics, and 11,000 in sales.

SaaS companies by industry

17. If you count every user session, the U.S. has a mind-blowing 54 billion SaaS customers.

18. China, the UK, and Canada each see about 3 billion SaaS user sessions, while India and Germany have 2 billion, and France has 1 billion.

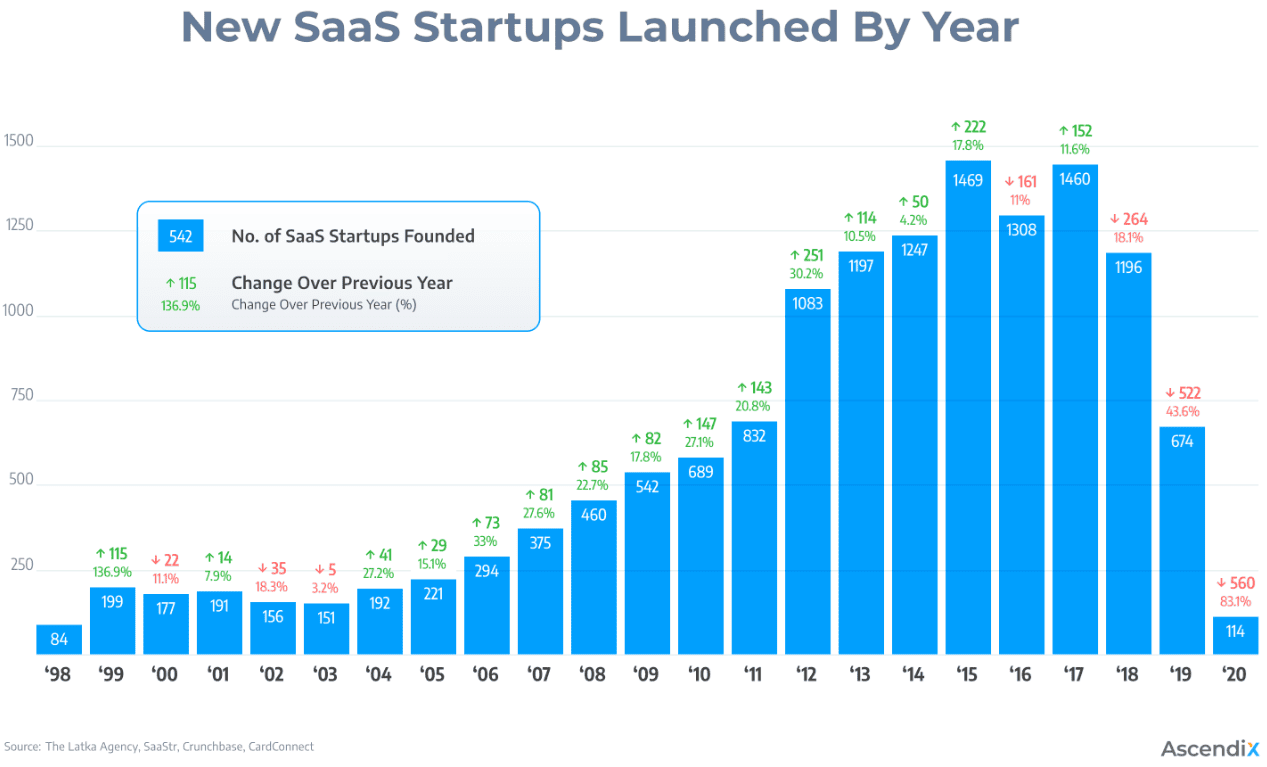

19. Two of the biggest years for SaaS company launches were 2015 and 2017, with 1,469 and 1,460 new businesses started in those years alone.

Growth of SaaS Startups Stats

What’s driving the surge in SaaS startups? In many cases, it’s lower entry barriers, more funding opportunities, and a clear shift away from traditional software.

The result: thousands of new SaaS businesses pop up every year across nearly every industry.

These stats show just how quickly the SaaS startup world is growing:

20. In 2023, about 450 new SaaS companies were launched around the world, and by mid-2024, that number had already climbed to 500, showing that interest in building SaaS businesses is still going strong.

21. Over the years, there’s been a steady rise in new SaaS startups, with 2018 seeing the biggest spike—over 2,000 companies launched that year.

New SaaS startups launched by year

22. The market has definitely become more crowded and competitive, but it hasn’t slowed growth for long. One noticeable dip happened in 2020, when only 114 new SaaS companies were created due to the impact of COVID-19 and the global slowdown.

23. If you go way back, SaaS was barely a thing in 1998, with just 84 companies. That number rose to 199 in 1999, marking the start of a slow but steady climb.

SaaS Companies by Region Stats

The U.S. might lead the way, but it’s not the only region betting big on SaaS.

Europe, India, and Latin America are all producing innovative software companies at a rapid pace.

In fact, since the 2015 funding boom, India is now home to over 2,000 SaaS startups alone.

Here are the number of SaaS companies stats that show how the SaaS market breaks down by region:

24. More than half of the top 20 SaaS-producing countries are in Europe (11 to be exact), making the region a strong force in the global SaaS scene.

25. Africa is the only inhabited continent without a country in the top 20.

26. Here’s a quick breakdown of SaaS companies by region:

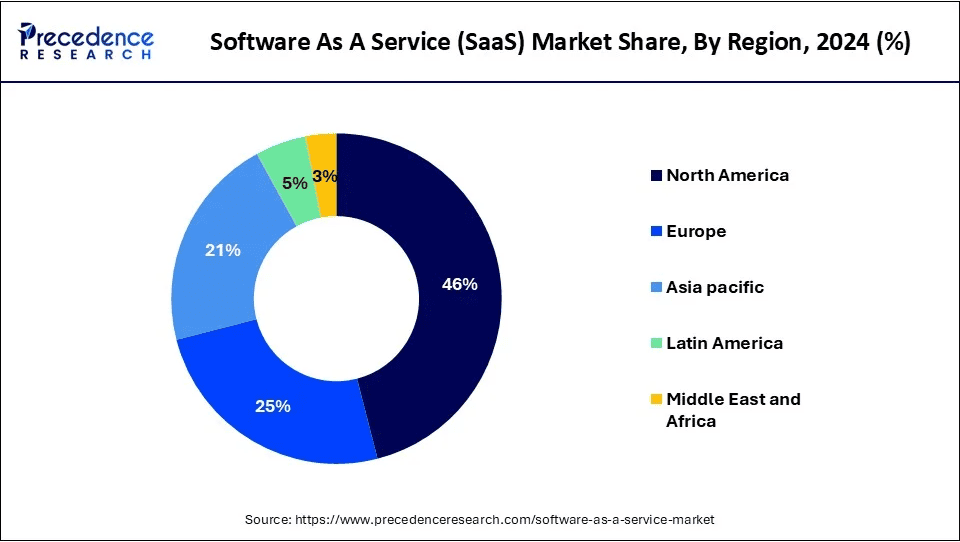

- North America leads with around 10,000 companies and about 59% of the market share.

- Europe comes next with over 4,500 SaaS companies, holding about 26% of the global market.

- Asia has close to 1,800 companies, followed by Oceania (408) and South America (342).

SaaS market share, by region

27. Back in 2020, the global SaaS market was worth around €107.5 billion ($113.8 billion). Of that, the U.S. alone made up €92 billion ($97.4 billion). The UK contributed about €7.5 billion ($7.9 billion) to the total.

28. Looking ahead to 2025, the market is about to grow to €229.5 billion ($242.9 billion)—more than double its 2020 value.

29. Even though the U.S. might lose a bit of market share, its SaaS sector is expected to reach €191 billion ($202.2 billion), nearly twice what it was.

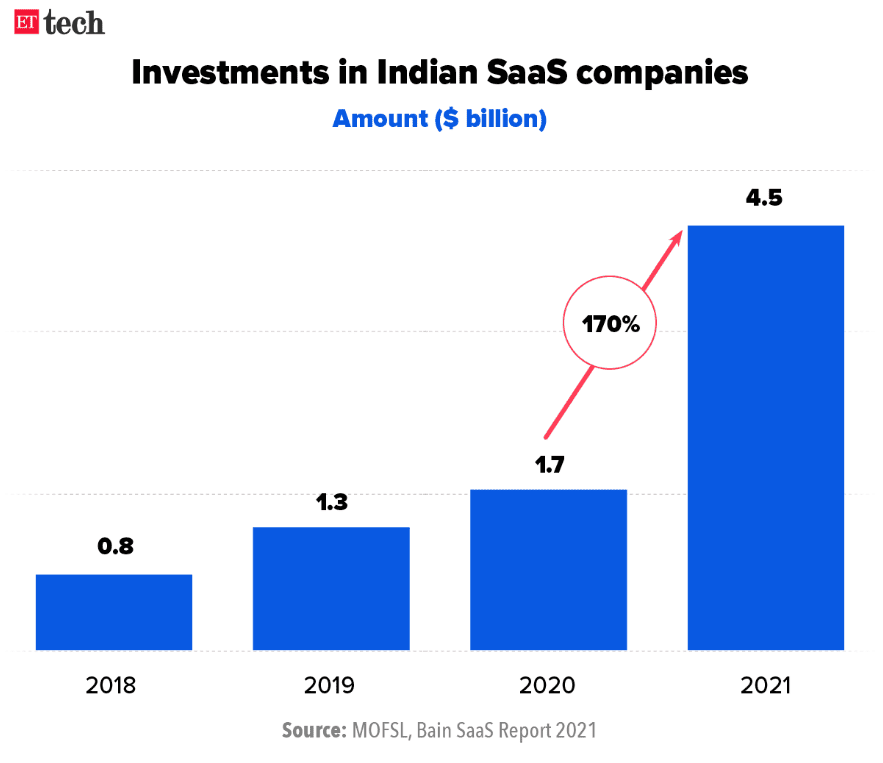

30. In India, SaaS investment skyrocketed to $4.5 billion in 2021, which was a 170% jump from the year before.

Investments in Indian SaaS companies

31. The SaaS markets in India, China, and Brazil are all expected to more than double between 2020 and 2025, showing fast growth in emerging regions.

32. Germany is set to see the biggest increase in Europe, with its SaaS market expected to grow from €6.85 billion to €16.3 billion by 2025.

SaaS Companies Market Share and Revenue Stats

In 2025, the global SaaS market is forecasted to hit $300 billion—and it’s not just the big names raking it in.

While companies like Microsoft and Salesforce dominate certain segments, smaller players are carving out niche markets (you’ll see how).

Here are the latest number of SaaS companies stats that show market share and revenue:

33. SaaS now makes up about 70% of all the software companies use, and that number is expected to grow to 85% by 2025.

SaaS apps make 70% of total company software use

34. Back in 2020, the top five SaaS companies combined held about 30.5% of the total market, and each one had slightly grown their share compared to the year before.

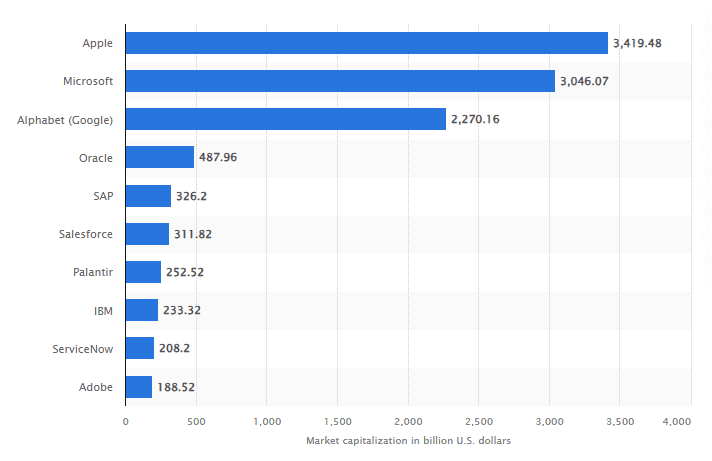

35. Salesforce is the leader, owning 9.3% of the market. In 2017, the company made $8.39 billion, but by 2021, that number jumped to $21.25 billion—a huge 153% increase.

36. Microsoft holds 8.7% of the market, and it’s been increasing revenue every year since 2016. In 2021, Microsoft’s annual revenue went up by 17.5%, hitting $168.09 billion.

37. SAP, based in Germany, controls 4.7% of the SaaS market. From 2009 to 2019, their revenue rose from $10.67 billion to $27.64 billion, and even after a dip in 2020, it bounced back to $27.84 billion in 2021, thanks to more cloud-based sales.

Top SaaS companies by market capitalization 2025

38. Oracle follows closely behind with 4% market share, but its revenue has stayed pretty steady over the past decade, always landing between $37.12 billion and $40.48 billion.

39. Rounding out the top five is Google, with a 3.8% share. Its cloud revenue has exploded in recent years, going from $4.06 billion in 2017 to $19.21 billion in 2021.

How Much Do Companies Spend on SaaS Tools?

Some businesses spend more on SaaS tools than they do on office rent.

The average mid-sized company uses over 130 software tools, and that number is only rising.

So, what does spending depend on? Industry, team size, and growth stage all play a big role in SaaS budgets.

Let’s dive into how much companies are really spending on SaaS:

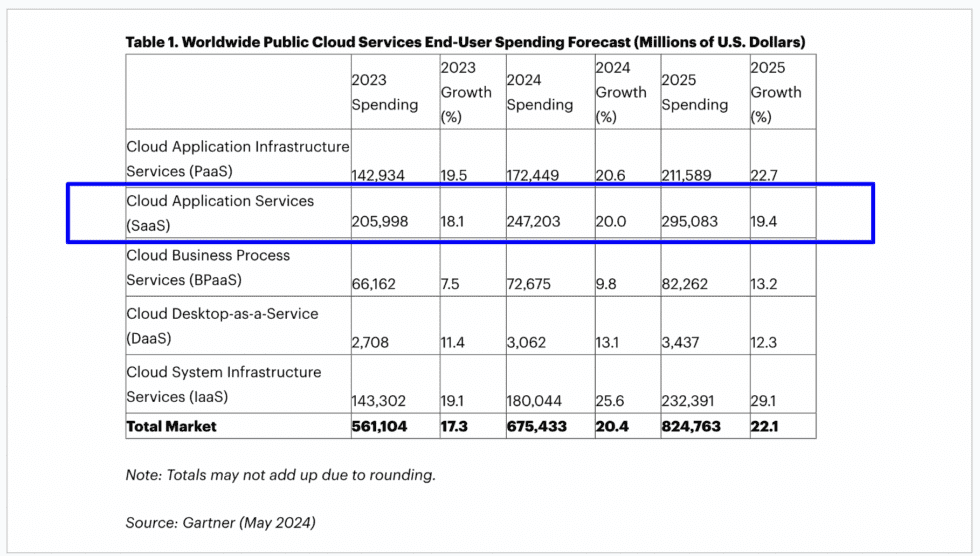

40. SaaS spending is climbing fast. According to Gartner, total global spend is expected to grow 20% this year from $247 billion, and rise another 19.4% next year, reaching $294 billion.

SaaS end-user spending forecast

41. Back in 2015, companies were spending much less, but by 2022, end-user SaaS spend had already hit $172 billion, which is a 450% jump in just a few years.

42. A recent study found that businesses spend about $7,900 per employee on SaaS, which is actually more than they spend on healthcare.

43. The average company now invests around $49 million in SaaS tools, with about $4,830 spent per employee—a small drop compared to $4,600 in 2023.

44. 53% of SaaS licenses go unused, which leads to an average of $21 million in wasted spend every year, and that figure keeps going up.

45. 85% of SaaS spending goes toward renewing existing subscriptions, while just 15% is spent on trying new tools, showing how companies are focused more on keeping what works.

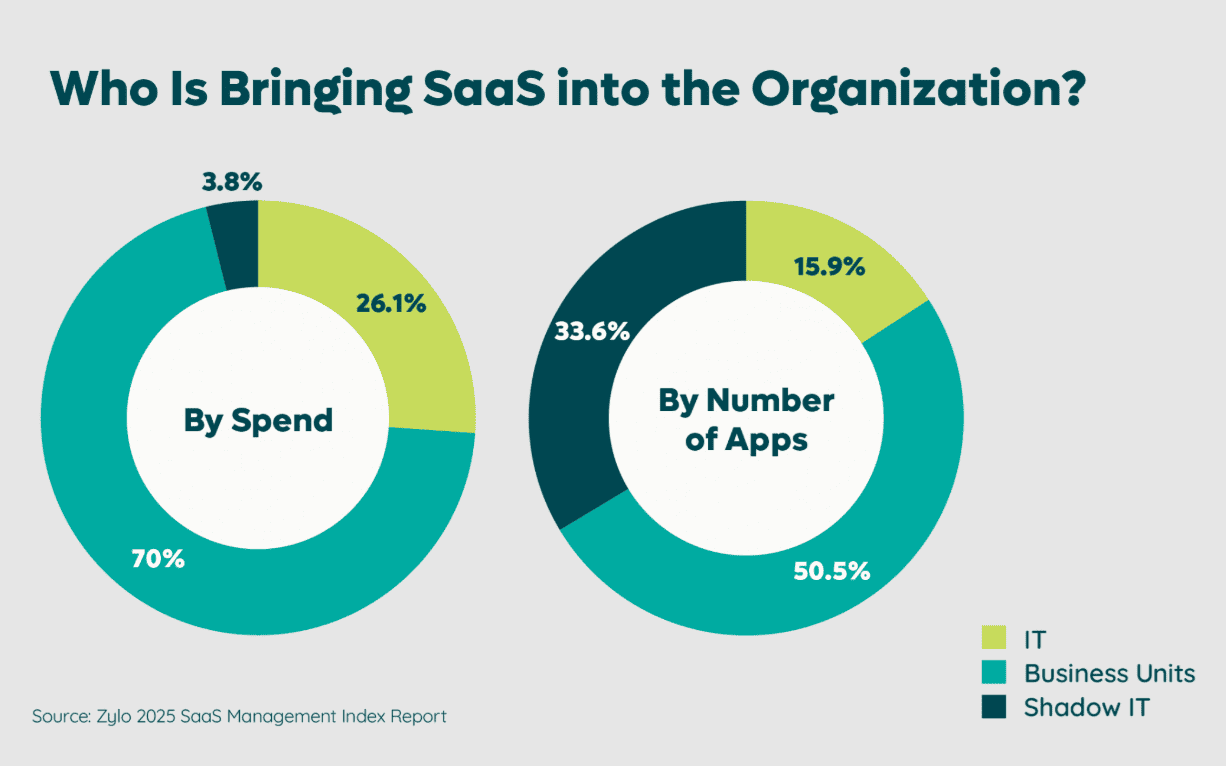

46. Business units now control 70% of SaaS budgets and are behind about half of all app purchases.

Who is responsible for SaaS spend in the organization

47. Interestingly, individual employees are responsible for 34% of all SaaS apps used, even though they only account for 4% of the total spend.

48. Not all companies are budgeting for SaaS properly—only 36% of traditional businesses allocate specific funds for it, while 44% of companies in transition are putting money aside for SaaS operations.

SaaS Industry Forecast and Future Outlook

Where is the SaaS industry heading next? What are the future trends for SaaS?

Experts predict AI-powered SaaS, vertical solutions, and embedded tools will lead the next wave of growth.

The following number of SaaS companies stats will show what the future may hold for SaaS companies over the next few years:

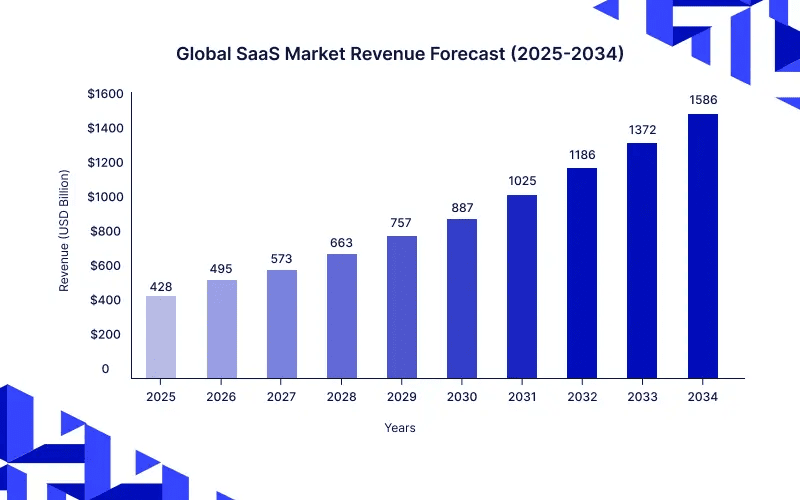

49. The SaaS market is projected to generate $428.78 billion in revenue by 2025.

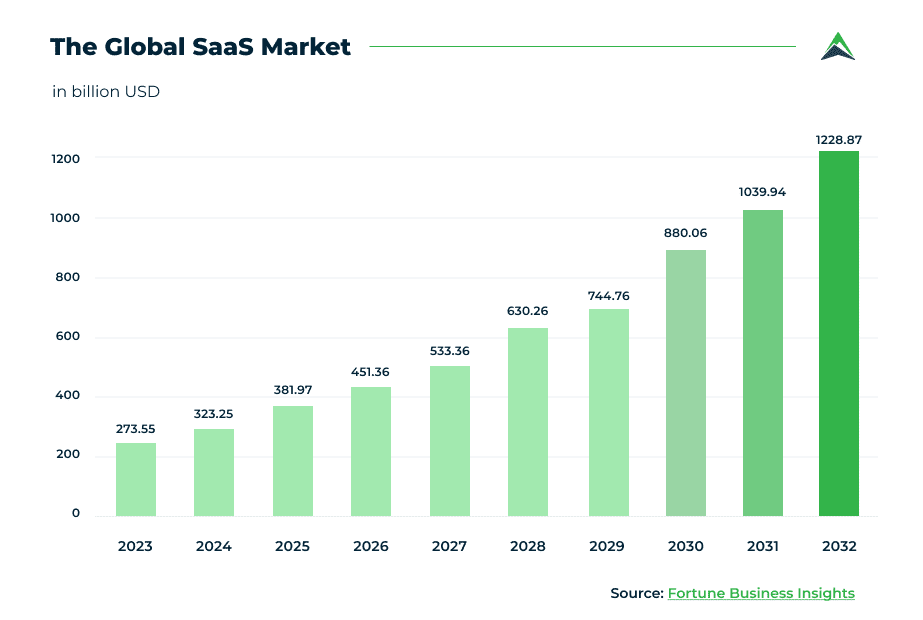

50. From 2025 to 2030, SaaS is expected to grow at a steady 15.65% per year, reaching a massive $887.05 billion by the end of the decade.

Global SaaS market revenue forecast (2025-2034)

51. On average, companies around the world are expected to spend about $115.70 per employee on SaaS tools in 2025.

52. The U.S. will continue to lead, with expected SaaS revenue of $221.79 billion in 2025, making up more than half of the global total.

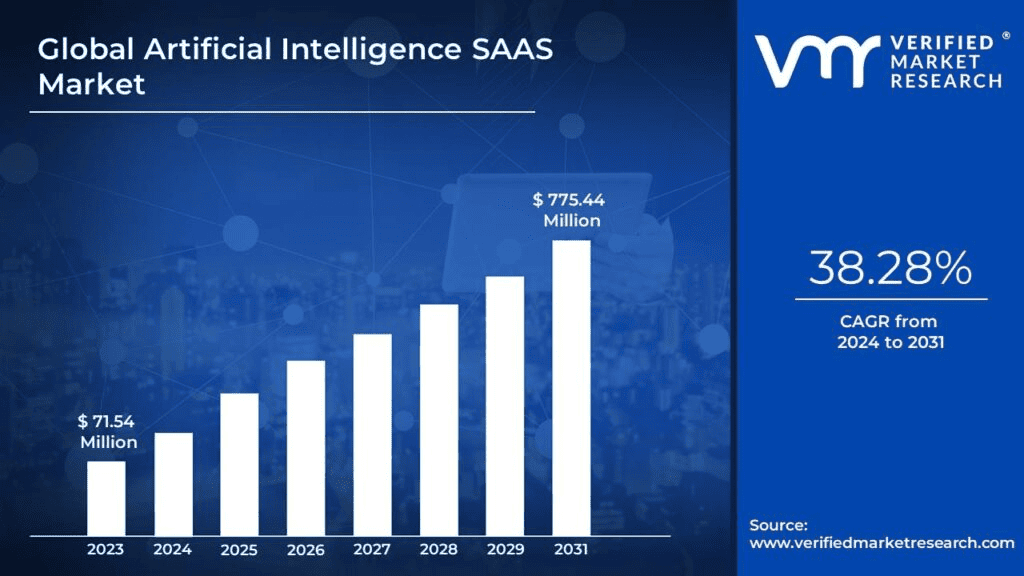

53. Looking further ahead, the AI-powered SaaS market alone could be worth $775.44 billion by 2031, growing at an impressive 38.28% annually from 2024 to 2031.

Global AI SaaS market forecast

54. By 2025, around 85% of all business apps are expected to be SaaS-based. This notes an increase from 70% in 2023.

55. While the U.S. remains the largest market, other regions are quickly catching up. India’s SaaS market is forecast to hit $50 billion by 2030, growing at a CAGR of 30–35%, with Europe and Latin America also expected to see strong growth in the coming years.

Conclusion

That wraps up our number of SaaS companies stats.

The SaaS world is growing fast, and it’s easy to see why. Businesses everywhere are turning to cloud-based tools to work smarter, cut costs, and stay flexible.

More companies are being built around this model every year, and existing ones are investing more in software that helps them run better.

With more spending, stronger demand, and new markets opening up, SaaS is set to keep expanding in a big way.