Fintech continues to disrupt the financial world by making banking, payments, and investing faster, smarter, and more accessible for users worldwide.

Fintech companies are steadily gaining market share from traditional institutions and reshaping how financial services are delivered.

According to a recent report by BCG and QED Investors, fintech revenues are projected to increase sixfold, from $245 billion to $1.5 trillion, by 2030.

This article brings together the latest fintech statistics for 2025, covering market growth, investment trends, adoption rates, and much more.

Top Fintech Stats

Fintech continues to evolve quickly, with new technologies, funding rounds, and global users shaping its future every day.

From mobile payments to digital lending, the numbers paint a clear picture of just how widespread and fast-growing this sector has become.

Whether you’re looking for adoption trends or headline-grabbing valuations, these top stats give you a strong overview of where fintech stands in 2025.

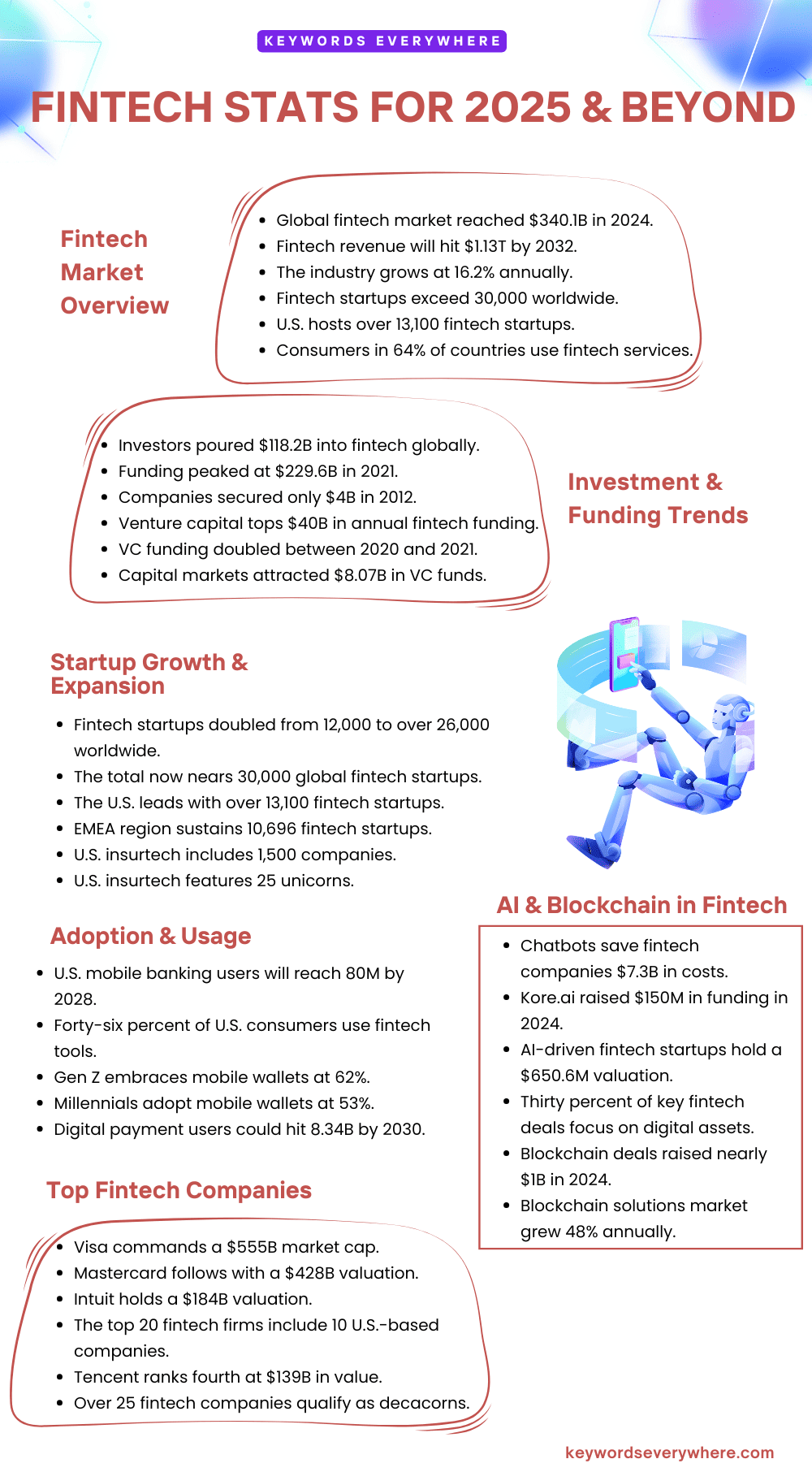

1. In 2024, the global fintech market reached a value of $340.10 billion, showing just how much this sector has grown in recent years.

2. By 2032, fintech revenue is expected to hit $1.13 trillion, with the industry growing steadily at a 16.2% annual rate.

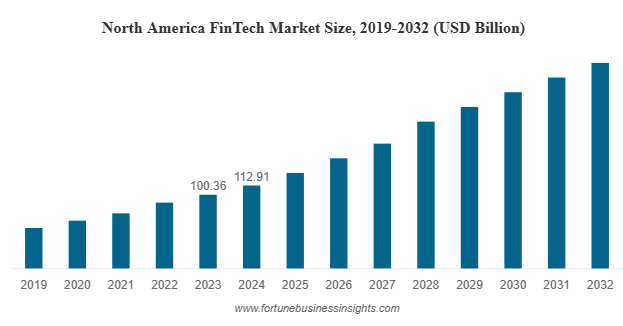

3. North America leads the world in fintech market share, accounting for $112.91 billion of the total.

North America FinTech Market Size

4. There are about 30,000 fintech startups around the world, and nearly 13,100 of them are based in the United States.

5. In China, about 90% of people use fintech banking services, showing how widespread these tools have become.

6. Visa stands as the world’s biggest fintech company, with a valuation close to $500 billion.

7. In the U.S., 17% of adults have either invested in, traded, or used cryptocurrency.

8. 4 in 10 financial companies believe blockchain will completely change how they deliver services in the future.

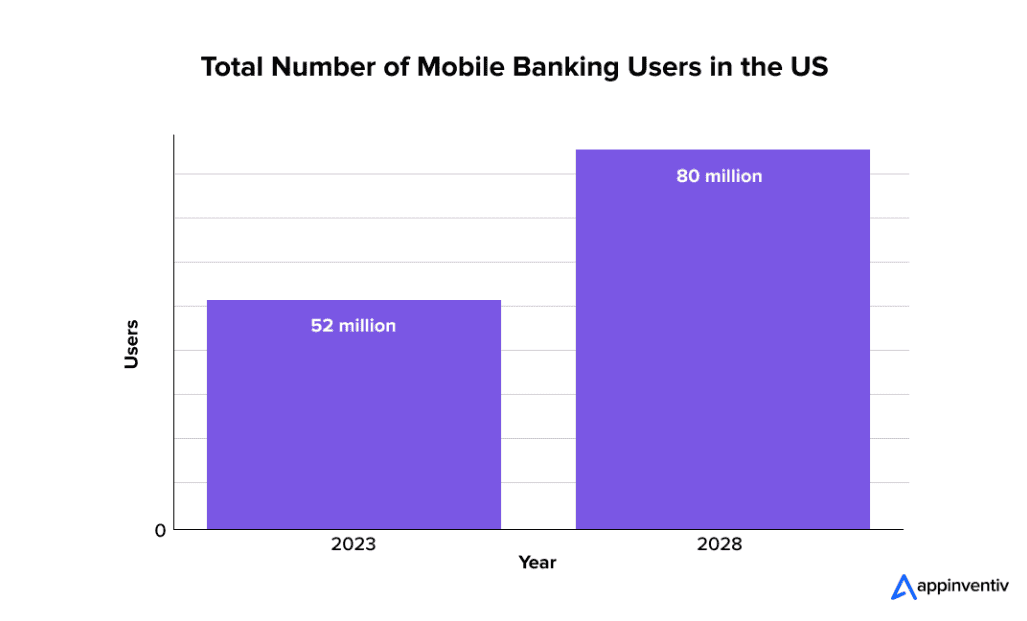

9. The number of people using mobile banking in the U.S. is expected to grow to 80 million by 2028.

Total number of mobile banking users

10. On a global scale, about 64% of consumers have started using fintech services in some form.

11. In the U.S., 46% of consumers say they’ve adopted fintech tools for managing their money.

12. Around 75% of users worldwide rely on fintech apps for payments and money transfers.

13. Three out of four fintech companies are also creating new job opportunities, especially in tech and finance roles.

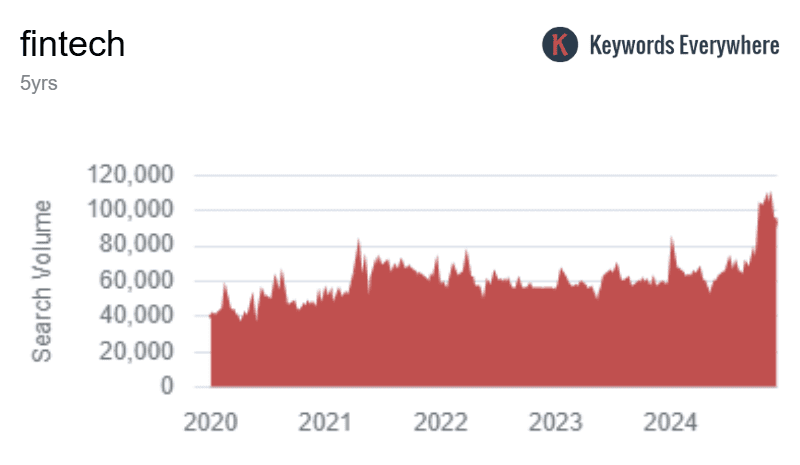

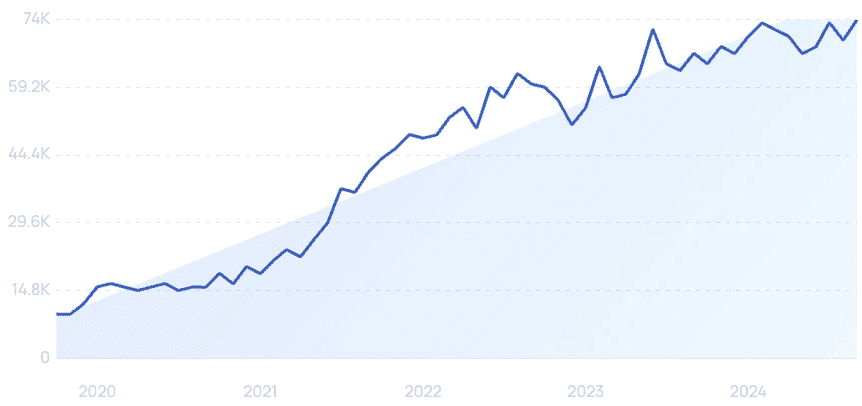

14. According to data from Keywords Everywhere, interest in fintech has been rising steadily over the past five years, with more people searching and learning about it than ever before.

Fintech Industry Size & Growth Stats

The financial technology industry has gone from niche to massive in just over a decade, and it’s not going to slow down anytime soon.

Fintech is now a multi-trillion-dollar market as it touches every corner of finance across regions and sectors.

Here are the Fintech stats that show current market size, projected growth, and more:

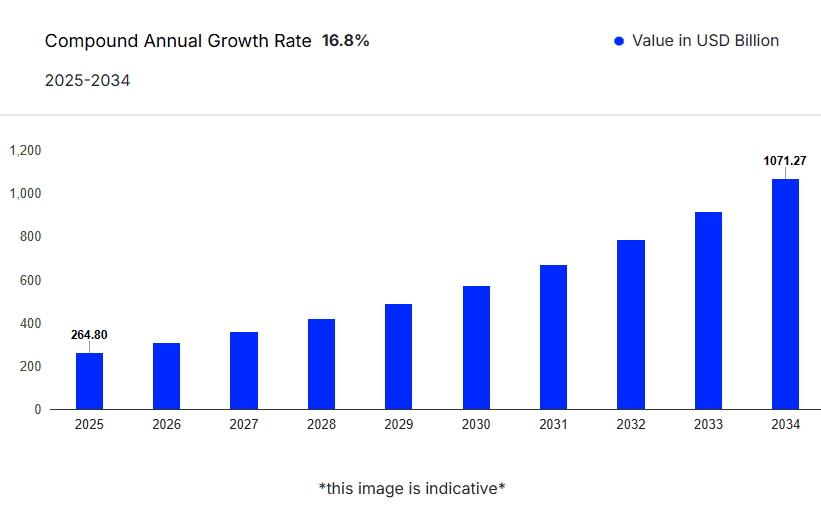

15. The fintech industry is currently valued at about $226.76 billion, and it’s expected to grow fast, reaching $917.17 billion by 2032 with an annual growth rate of 16.8%.

FinTech industry market size and outlook 2025

16. Some of the top-performing fintech stocks on NASDAQ in early 2025 included Sezzle, Dave, Root, Robinhood Markets, and Priority Technology Holdings.

17. Eight out of the ten most valuable fintech unicorns—privately held companies valued over $1 billion—are based in the United States, highlighting its leadership in the global fintech scene.

18. The number of fintech startups has doubled since 2019, growing from around 12,000 to over 26,000 worldwide in just a few years.

19. As of February 2025, Visa had a market cap of $696.6 billion, while Mastercard was valued at $521.8 billion, making them two of the biggest names in global fintech.

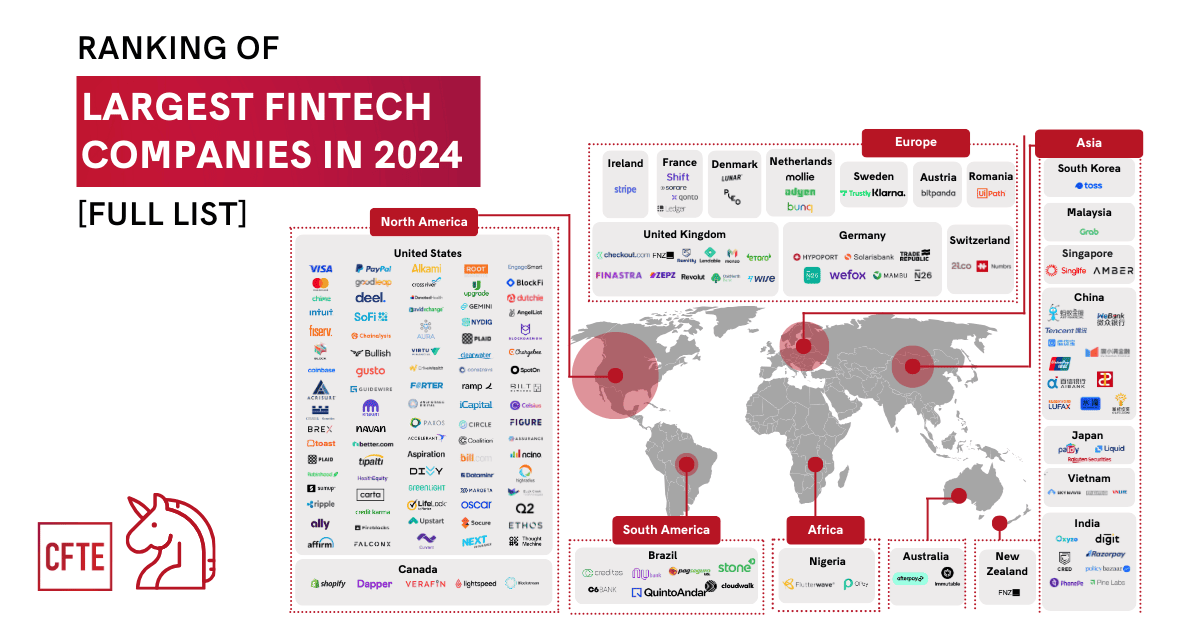

20. The largest fintech companies in the world are mostly based in the U.S. and China, with both countries dominating in terms of market value and industry influence.

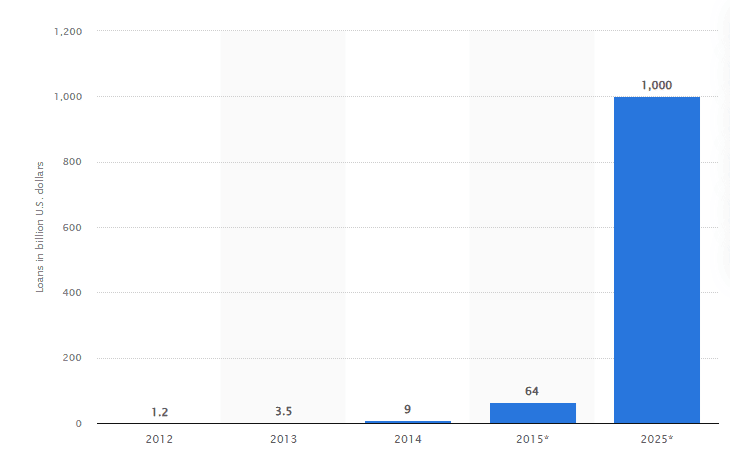

21. The global peer-to-peer lending market is expected to grow significantly, potentially reaching nearly $1 trillion by 2050.

Value of global peer to peer lending from 2012 to 2025

22. Since 2017, global fintech industry revenue has more than doubled, rising from $90.5 billion to over $180 billion, with continued growth expected in the years ahead.

Fintech Investment & Funding Stats

Fintech continues to attract massive investments year after year as venture capital firms, private equity groups, and global investors pour money into promising startups and fast-growing platforms.

Funding in this sector reflects more than just financial support—it reveals confidence in the future of digital finance.

In the following Fintech stats, you’ll see how much capital is flowing into fintech and which markets are leading in investment:

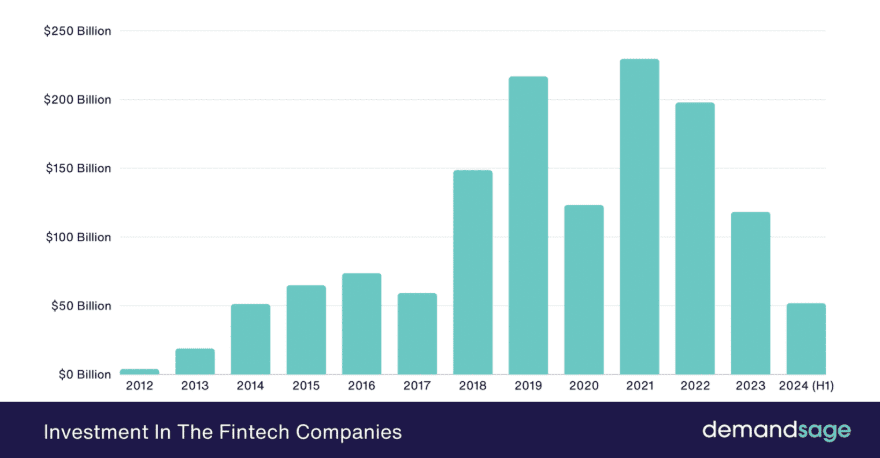

23. In recent years, fintech companies have attracted major investment, with $118.2 billion poured into the industry globally.

24. The highest level of fintech investment happened in 2021, when the industry hit a record $229.6 billion in funding.

Investment in the FinTech companies

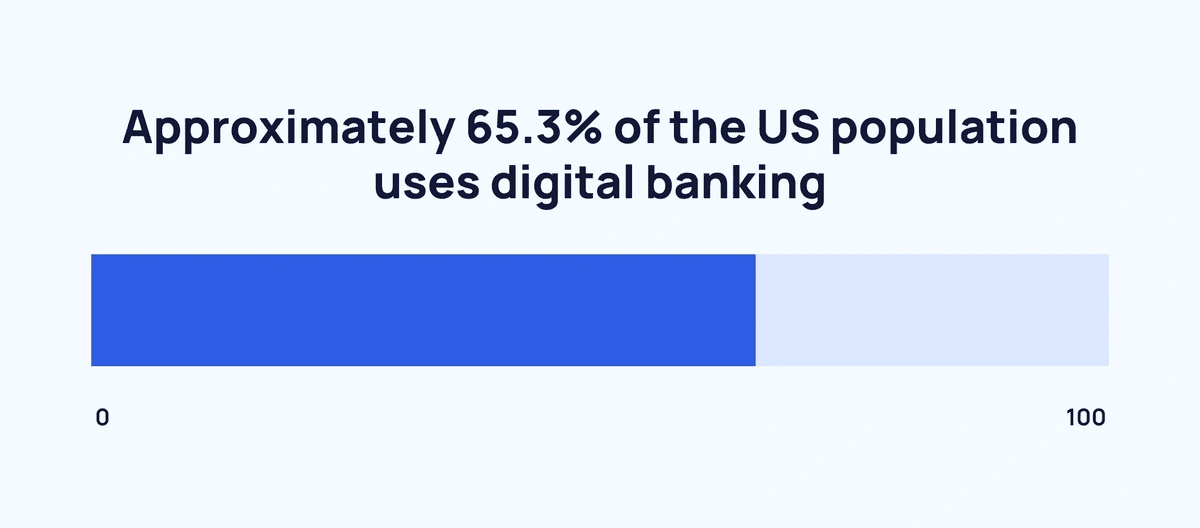

25. The lowest investment year was 2012, when fintech companies received just $4 billion, showing how far the sector has come since then.

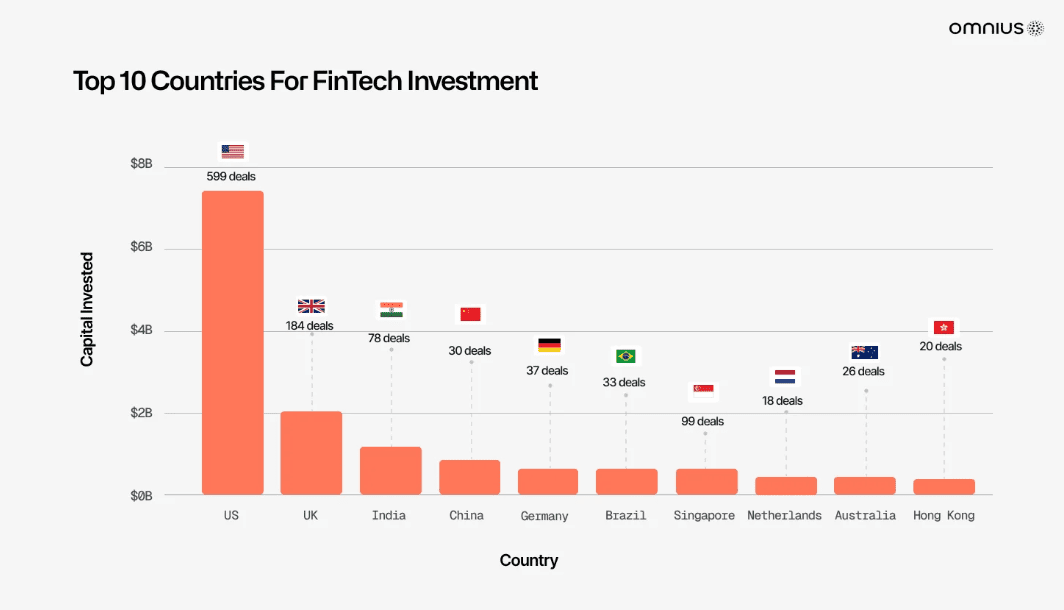

26. In the first half of 2024, the top 10 countries for fintech investment remained mostly the same as in 2023, with little change in where the money is going.

Top 10 countries for FinTech investment

27. Investment in the Americas dropped slightly, from $38.6 billion in the second half of 2023 to $36.8 billion in the first half of 2024, with most of the money going into:

- Mergers and Acquisitions: $26.8 billion

- Venture Capital: $9.4 billion

- Private Equity: $569 million

28. In Europe, the Middle East, and Africa (EMEA), total fintech investment fell from $19.2 billion to $11.4 billion during the same period:

- Venture Capital: $5.4 billion

- Mergers and Acquisitions: $5.6 billion

- Private Equity: $403 million

29. The Asia-Pacific region also saw a decline, with total fintech investment dropping from $4.6 billion in H2 2023 to $3.6 billion in H1 2024:

- Venture Capital: $3.5 billion

- Mergers and Acquisitions: $310 million

- Private Equity: $8 million

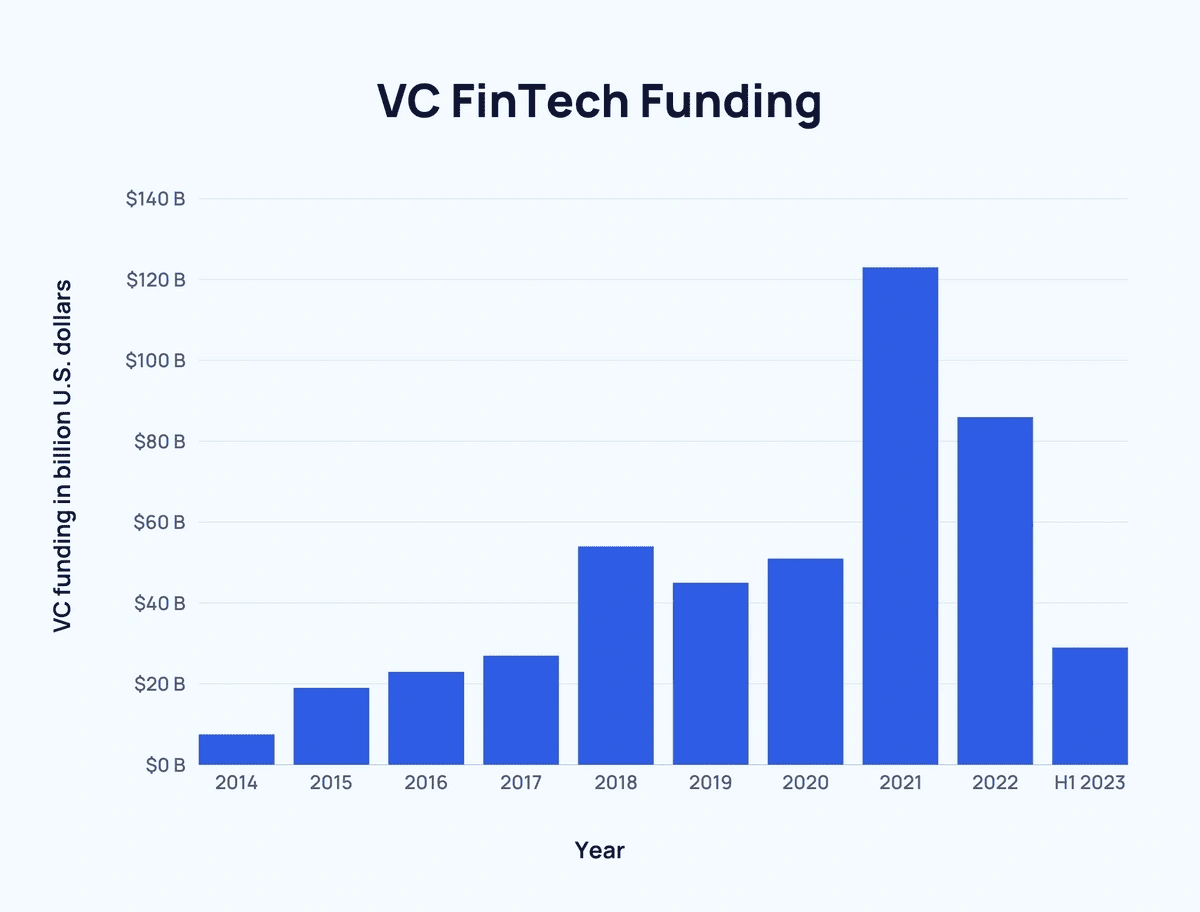

30. Venture capital investment in fintech has stayed strong, despite recent dips, consistently topping $40 billion per year.

31. In fact, VC funding more than doubled between 2020 and 2021, reflecting the sector’s rapid expansion during that time.

VC FinTech Funding

32. The Americas lead the world in fintech VC funding, attracting the biggest share of global investment.

33. Several fintech sectors receive over $5 billion in venture capital each year, with capital markets bringing in the most—$8.07 billion between 2016 and Q1 2021. Next came payments at $6.03 billion and wealth management at $5.43 billion.

Fintech Startup Landscape Stats

Startups play a major role in driving fintech innovation as they introduce new ways to save, spend, lend, and invest.

Are new players still entering the scene, and where are the most active fintech hubs located?

These Fintech stats show how fintech startups have grown in number and how the startup landscape continues to shift in 2025.

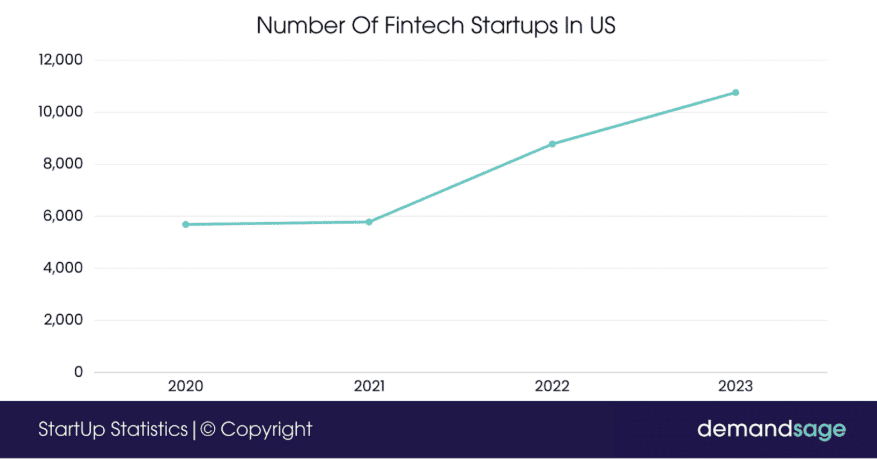

34. As of 2025, there are nearly 30,000 fintech startups operating around the world, showing just how much this space has grown.

35. The United States leads the way with over 13,100 fintech startups, while the EMEA region (Europe, Middle East, and Africa) is home to 10,696 startups.

FinTech startups growth in the US

36. In just the past two years, the total number of fintech startups has jumped by more than 50%, growing from 12,000 to over 26,000 worldwide.

37. While growth remains strong, funding has slowed. In the first nine months of 2024, global fintech startups raised $24.6 billion, which is 24% less than they raised during the same time in 2023.

38. In the insurtech space, the U.S. has a big presence with 1,500 companies, including 25 unicorns—startups valued at over $1 billion.

39. One standout example is Sunbit, a fintech startup that has raised more than $770 million in funding so far.

Sunbit five-year search growth

Fintech Adoption Rates Stats

Fintech tools have become a normal part of daily life for millions as people turn to mobile apps, digital wallets, and online services instead of visiting a bank branch or writing a check.

Adoption rates have jumped in recent years as consumers and businesses seek faster, more flexible financial solutions.

These Fintech stats reveal where fintech adoption is strongest, how different age groups are engaging with it, and which services are seeing the most growth.

40. Digital payments are leading the fintech market in terms of user numbers, with over 3 billion people using them in 2024. That number is expected to grow to 4.45 billion by 2029.

41. The number of digital payment users could reach 8.34 billion globally by 2030.

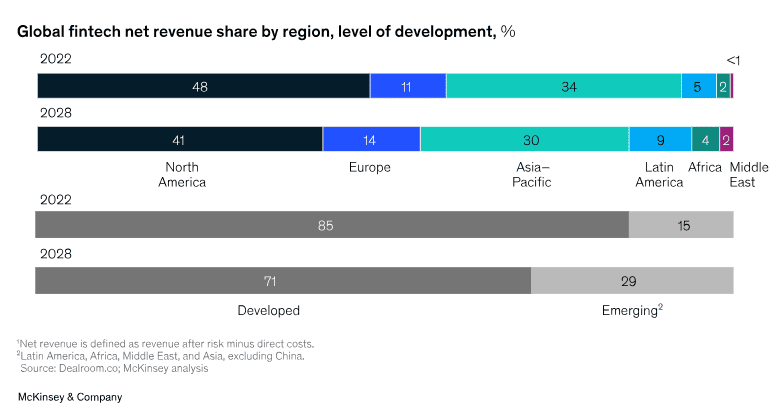

42. The fintech industry is growing faster than traditional banking, with revenues expected to rise at nearly three times the pace of banks between 2022 and 2028.

Global FinTech net revenue share by region

43. When it comes to country-level adoption, China continues to lead the way. Back in 2019, 92% of the population used fintech for banking and payments, making it the global leader in digital finance adoption.

44. In the U.S., fintech-based personal loan activity has jumped by 33%.

45. The use of digital banking in the U.S. has also grown steadily. In 2018, about 61.3% of Americans used digital banking services. By 2022, that number had risen to 65.3%, with a consistent increase of at least 0.5% per year.

Majority of the US population uses digital banking

46. Younger generations are driving the growth of mobile wallets. About 62% of Gen Z and 53% of millennials use mobile wallets regularly, while only 21% of baby boomers have adopted the technology.

AI & Blockchain in Fintech Stats

Artificial intelligence and blockchain are no longer future trends—they are core technologies powering some of fintech’s most important developments.

How are these tools being used, and what kind of impact are they making?

These Fintech stats explore how both technologies are driving major changes across digital finance platforms.

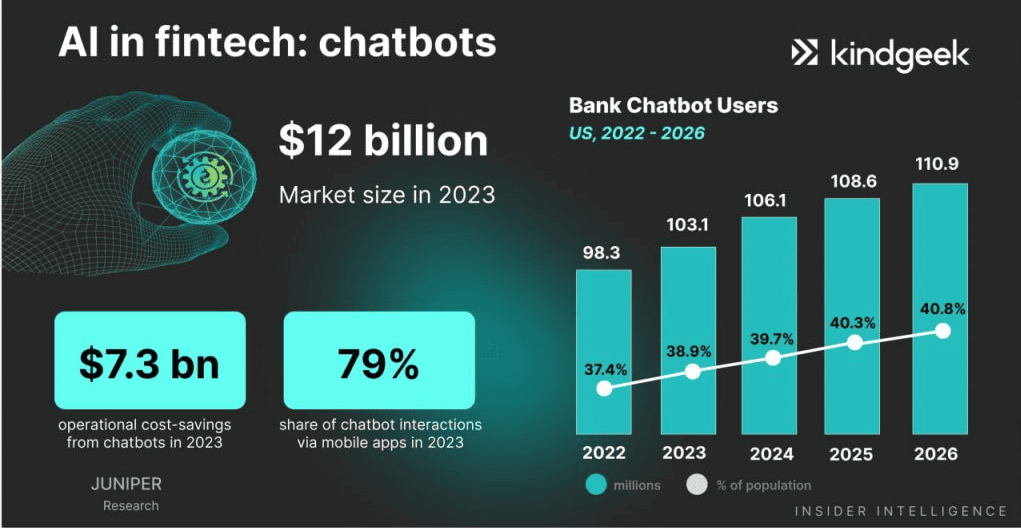

47. Fintech companies have saved around $7.3 billion in operating costs by using chatbots.

AI in FinTech

48. In 2024, Kore.ai, a conversational AI platform, raised around $150 million in funding to grow its team and expand its product offerings across more industries.

49. The average pre-money valuation for fintech and AI startups at the expansion stage reached $650.6 million in 2024.

50. In 2024, 30% of the biggest early-stage fintech deals were in the digital asset space, signaling a renewed interest in crypto and blockchain companies.

51. The crypto, blockchain, and digital assets sector saw 91 expansion-stage deals in 2024, totaling nearly $1 billion in funding as investors backed new platforms and technologies.

52. Between 2018 and 2024, the global blockchain solutions market grew at an impressive 48% annual rate.

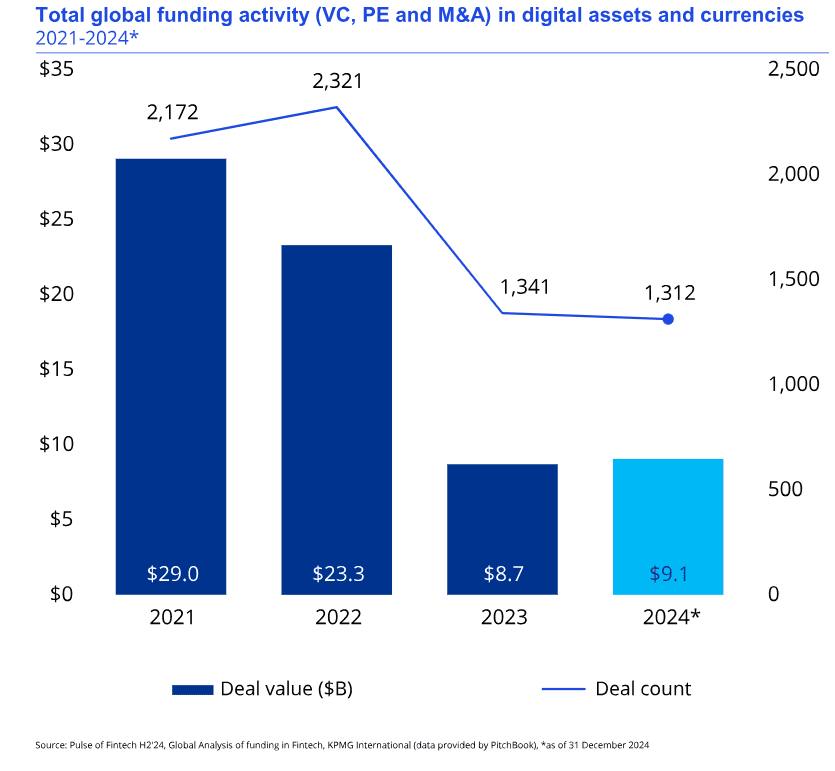

53. Worldwide investment in digital assets and currencies increased from $8.7 billion in 2023 to $9.1 billion in 2024.

Total global funding activity in digital assets and currencies

54. On April 22, 2025, the Bitcoin network processed 518,267 transactions in a single day, and there are now over 19 million Bitcoins in circulation.

Leading Fintech Companies Stats

A handful of fintech companies have risen to global prominence as they serve millions of users, process billions in transactions, and lead the way in innovation.

Some of these companies started just a few years ago but now hold valuations that rival traditional financial institutions.

Here are the Fintech stats that reveal the list of the leading Fintech companies in 2025:

55. Visa is currently the biggest fintech company in the world, with a market value of $555 billion, making it the clear leader in this space.

56. Mastercard comes in second with a strong valuation of $428 billion, followed by Intuit at $184 billion.

57. Out of the top 20 fintech companies by market value, 10 are based in the United States.

Largest FinTech companies worldwide

58. China only has two companies in the top 20, but both rank high—Tencent is 4th and Ant Financial is 6th.

59. Other countries with one company each in the top 20 include the UK, Ireland, Brazil, the Netherlands, India, Romania, Luxembourg, and Singapore, showing just how global the fintech market has become.

60. More than 25 fintech companies worldwide have crossed the $10 billion mark, earning them the status of “decacorns,” which is a rare milestone in the startup world.

61. Here are the top 10 most valuable fintech companies as of 2024, according to Exploding Topics:

| Rank | Company | Country | Market Cap |

| 1 | Visa | United States | $555 billion |

| 2 | Mastercard | United States | $428 billion |

| 3 | Intuit | United States | $184 billion |

| 4 | Tencent | China | $139 billion |

| 5 | Fiserv | United States | $87 billion |

| 6 | Ant Financial | China | $79 billion |

| 7 | PayPal | United States | $64 billion |

| 8 | Adyen | Netherlands | $50 billion |

| 9 | Stripe | Ireland | $50 billion |

| 10 | Nubank | Brazil | $42 billion |

Fintech Trends to Watch

Fintech continues to grow rapidly as new technologies emerge and consumer expectations shift toward seamless, real-time financial services.

So, what’s shaping the next wave of innovation, and which trends are gaining real traction?

This section shows the latest data behind the movements that are defining the future of fintech.

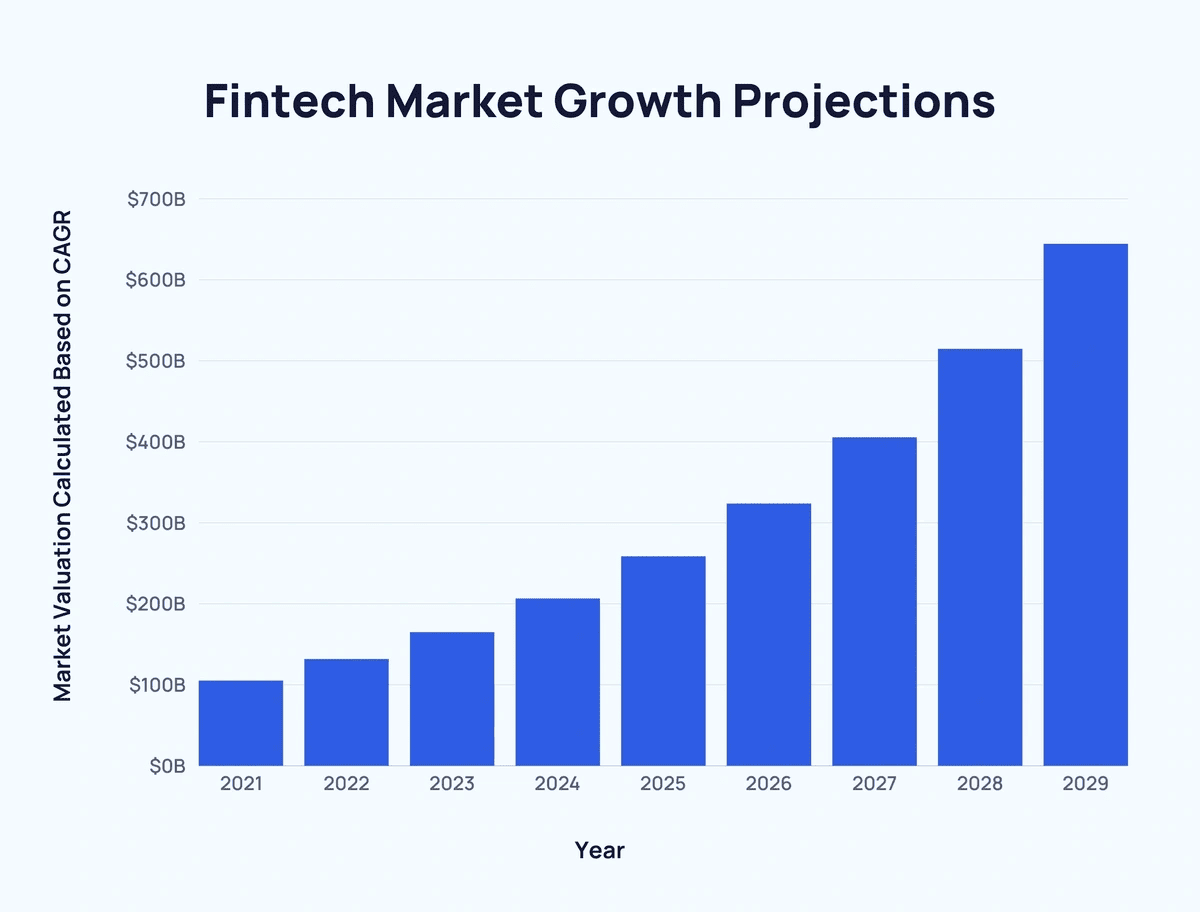

62. The fintech industry is growing fast—it’s expected to reach $644.6 billion by 2029, thanks to a strong annual growth rate of 25.18%.

Fintech market growth projections

63. Artificial intelligence in fintech is also picking up speed, with the market set to increase from $14.13 billion in 2024 to $17.79 billion in 2025.

64. Digital wallets are becoming a global standard, and by 2027, they’re expected to handle over $25 trillion in payments worldwide, making up nearly half of all sales (whether online or in stores).

65. Online payment fraud is a big concern, with global losses estimated to cross $362 billion between 2023 and 2028.

66. Robo-advisors are gaining more users each year, with around 1.5 million more people expected to start using them by 2028, as automated investment tools continue to grow in popularity.

67. Most top-level banking leaders agree that fintech is making a big impact, especially in areas like digital wallets and mobile payments.

Conclusion

That wraps up our detailed look at the current state and future of fintech.

From skyrocketing valuations and AI breakthroughs to the steady rise of digital wallets and robo-advisors, it’s clear this industry isn’t slowing down.

With nearly 30,000 startups worldwide and projections pointing to $1.13 trillion in revenue by 2032, fintech is not just transforming finance—it’s rewriting the rules for how the world banks, pays, invests, and saves.