What once relied on department store counters and glossy magazine ads has now transformed into a fast-moving world of online reviews, social media trends, and tech-powered shopping experiences.

While legacy brands are expanding their reach, indie startups are making bold moves, and consumers are becoming more thoughtful about what they buy and why.

In this article, we’ll dive into the most important beauty industry stats—covering everything from major market shifts and consumer spending habits to the rise of clean products and more.

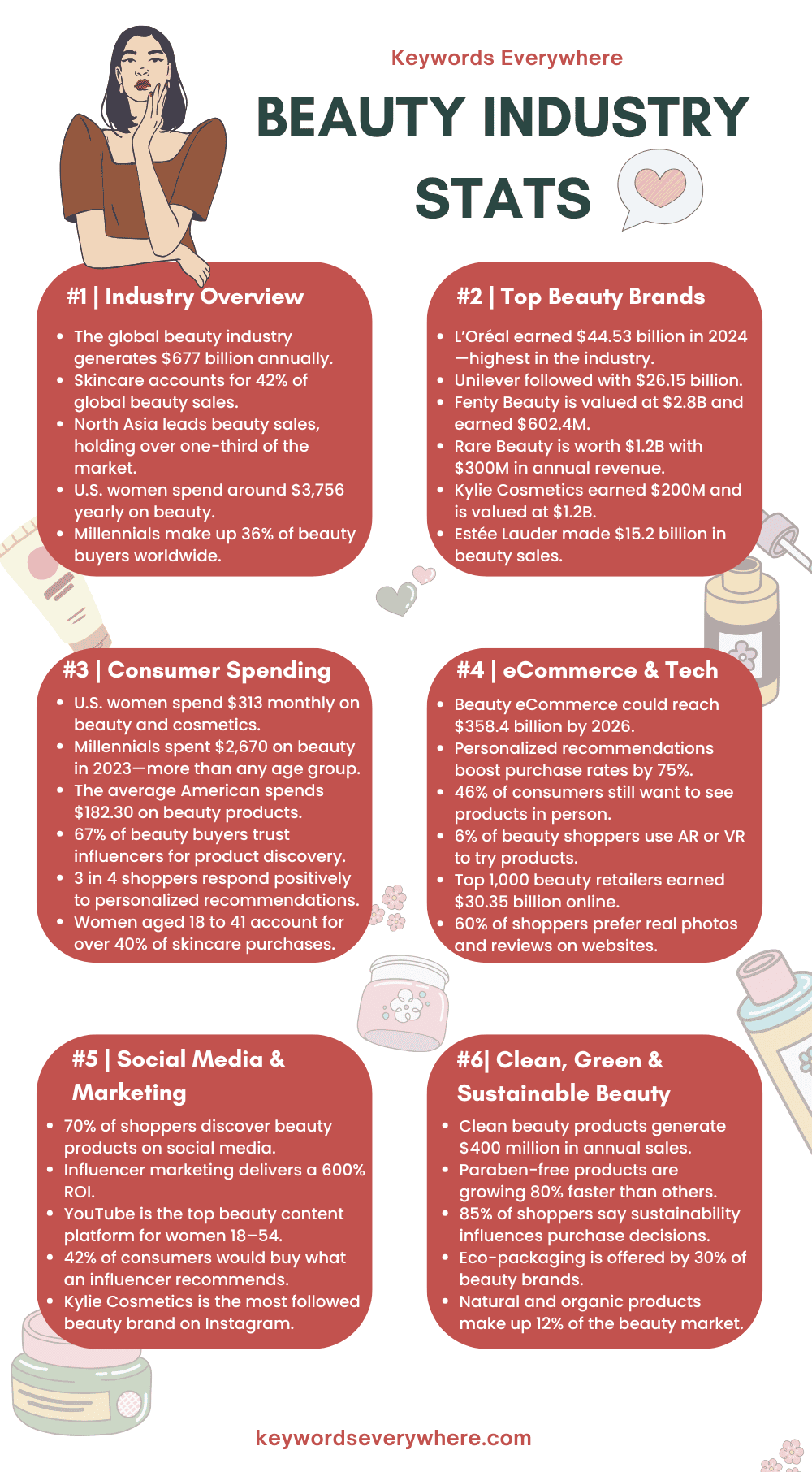

Beauty Industry Statistics: Overview

Have you ever stopped to think about just how massive the beauty industry is? How fast it’s growing, and what do people care about most?

Whether it’s skincare routines going viral or new products promising next-level results, beauty has become more than just looking good—it’s now tied to wellness, identity, and even self-care.

Below are the beauty industry stats that reveal just how big this world has become and where it’s heading next.

1. The global beauty industry brings in about $677 billion each year, and it’s expected to grow even more in 2025.

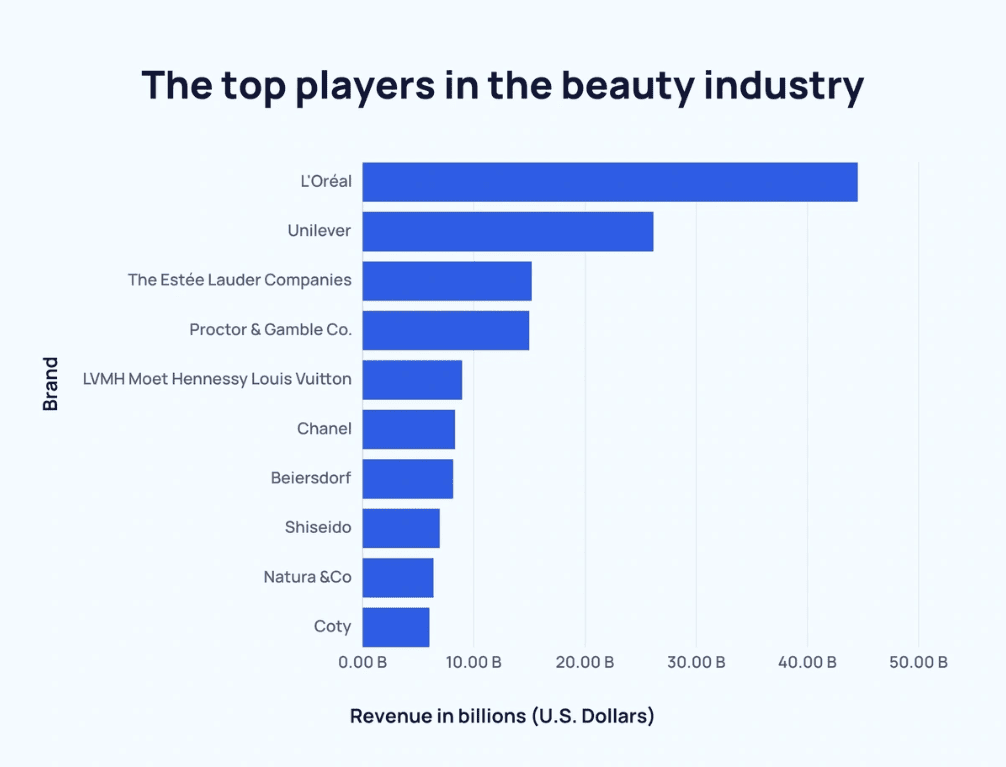

2. L’Oréal is still leading the beauty world with more than 40 billion global sales, making about $18 billion more in sales compared to its closest competitor, Unilever. Other major names in the top five include Estée Lauder, Procter & Gamble, and Shiseido.

Top players in the beauty industry

3. North Asia buys the most beauty and personal care products, making up over a third of the global market. North America comes next with about 26%, and Europe follows with 22%.

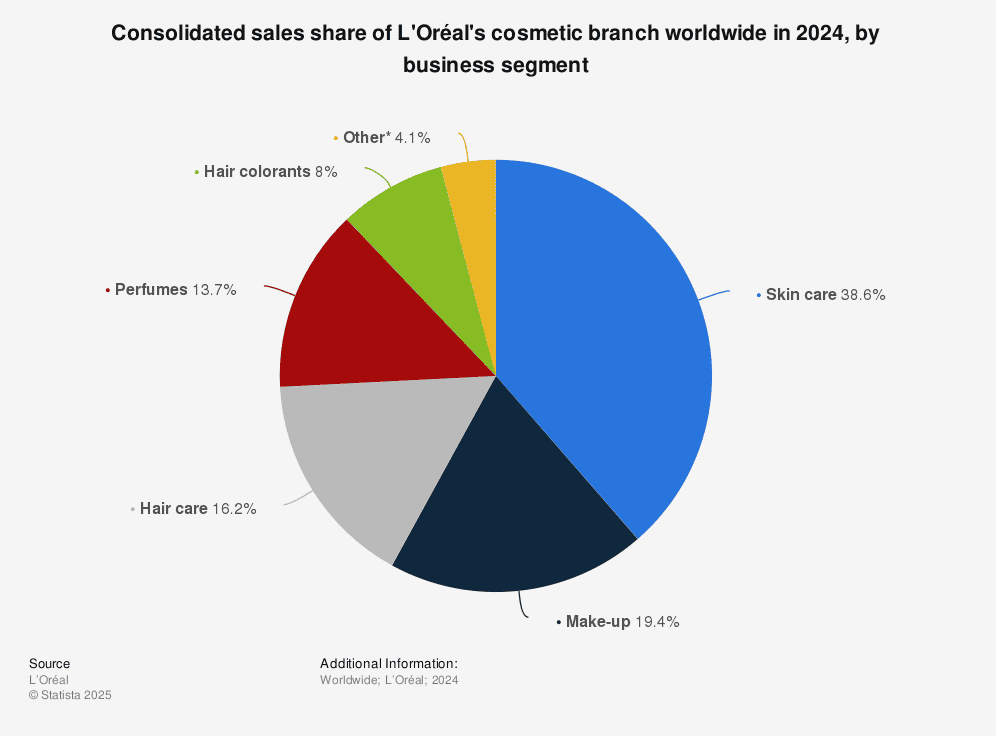

4. Skincare is the biggest category in the beauty industry, making up around 42% of all beauty sales worldwide.

5. On average, women in the U.S. spend about $3,756 a year on beauty products and services, while men spend around $2,928 a year on the same types of items.

6. The men’s personal care market is growing fast and is expected to reach $276.9 billion by 2030, with steady growth of about 8.6% each year until then.

7. Millennials make up 36% of beauty buyers around the world, showing just how much this age group influences the industry.

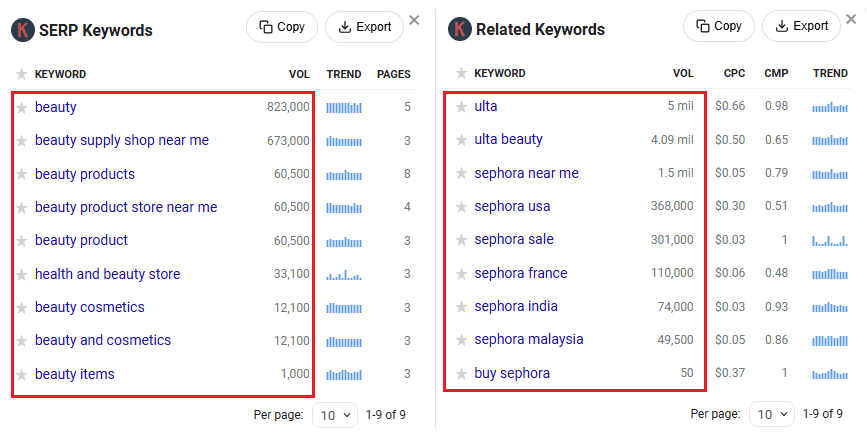

8. According to Keywords Everywhere, beauty-related searches on Google are very high, especially phrases like “shop + brand name” or “buy + brand/product name,” showing that people are actively looking to discover and purchase beauty items online.

Top Companies and Brands in the Beauty Industry

Some beauty brands have become household names over the years, while others seem to explode overnight thanks to smart marketing and loyal followings.

From long-established giants to rising celeb-owned brands that disrupt the market, the business side of beauty is just as fascinating as the products themselves.

Here are the beauty industry stats that highlight which companies are dominating and shaping the future of beauty.

Top Beauty Brands by Revenue

9. L’Oréal had the highest beauty revenue in 2024, pulling in a massive $44.53 billion, far ahead of other companies. Unilever came in second with $26.15 billion, and Estée Lauder followed with $15.2 billion in 2025.

Sales share of L’Oreal’s cosmetic branch worldwide, by business segment

10. Procter & Gamble (P&G) earned $15 billion, securing the fourth spot among top beauty brands.

11. LVMH made $8.94 billion from beauty products in 2024, showing how strong luxury brands continue to perform in this space.

12. Chanel followed closely with $8.32 billion, while Beiersdorf, known for skincare products like Nivea, earned $8.14 billion.

13. Shiseido brought in $6.94 billion, keeping its position as a major player in the Asian and global beauty markets.

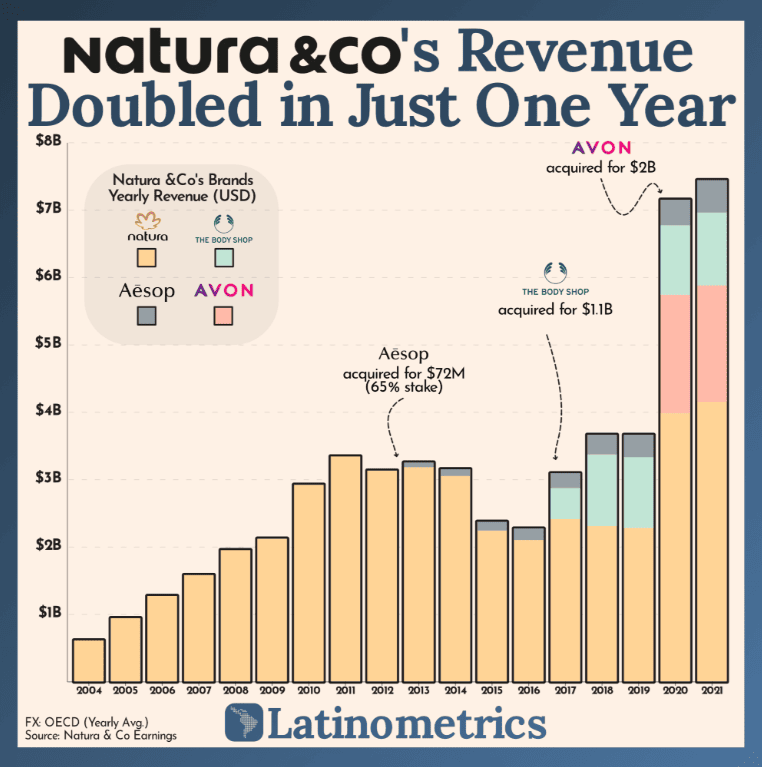

14. Natura & Co., the parent company of brands like Avon and Aesop, made $6.39 billion, staying competitive in both the Western and Latin American markets.

Natura & Co’s revenue growth

15. Coty, which owns several fragrance and beauty lines, rounded out the top ten with $6 billion in beauty revenue.

Top Celebrity-Owned Beauty Brands by Value and Revenue

16. Fenty Beauty by Rihanna leads the celebrity beauty world with a $2.8 billion valuation and $602.4 million in revenue in 2024.

17. Rare Beauty by Selena Gomez follows with a $1.2 billion valuation and $300 million in annual revenue.

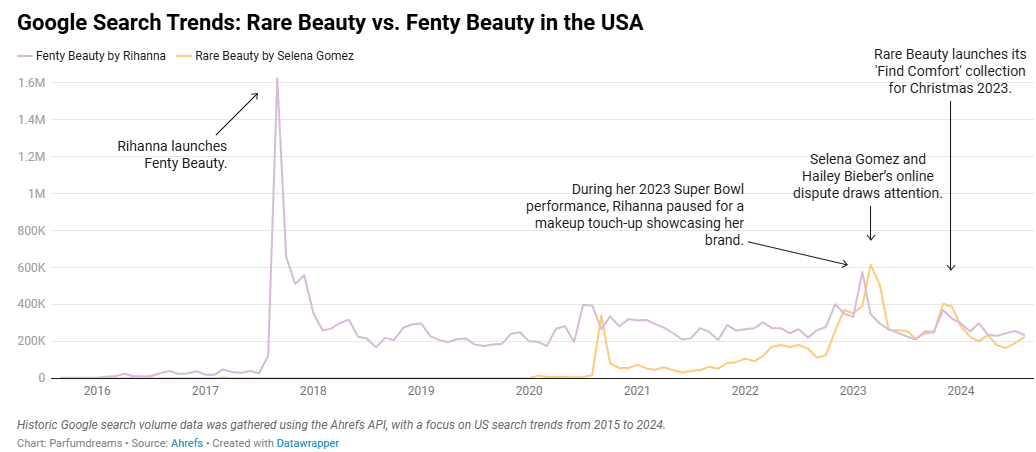

Rare Beauty vs. Fenty Beauty in the USA

18. Kylie Cosmetics by Kylie Jenner is also valued at $1.2 billion, with a yearly revenue of $200 million, proving that the brand still holds a strong influence.

19. Honest Beauty by Jessica Alba, part of her larger Honest Company, is worth about $550 million and brought in $300 million in beauty sales in 2024.

20. Goop by Gwyneth Paltrow, known for its luxury wellness approach, is valued at $250 million and made $75 million in beauty-related revenue last year.

21. Anomaly Haircare by Priyanka Chopra Jonas stands out in the haircare space with a $150 million valuation and $50 million in revenue, especially strong for a newer brand.

22. Jeffree Star Cosmetics, once a viral hit, is now valued at $100 million with revenue of $11 million.

23. Haus Labs by Lady Gaga, rebranded and relaunched in recent years, is valued at $90 million and earned $30 million in 2024.

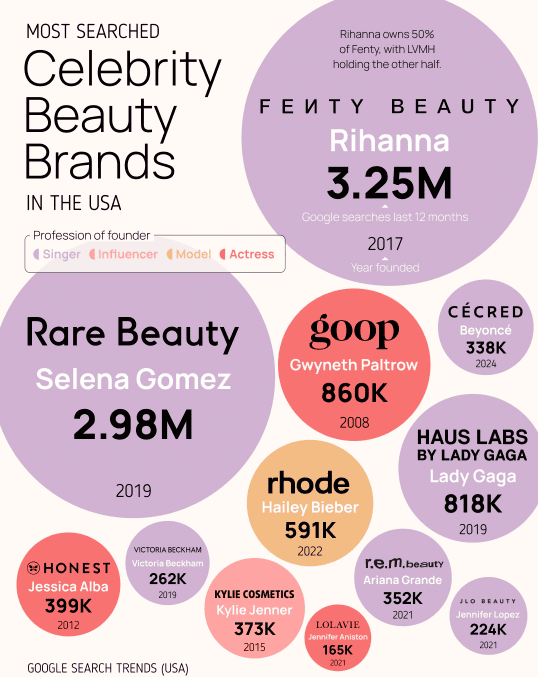

Most-searched celebrity beauty brands

24. r.e.m. Beauty by Ariana Grande comes in with a $60 million valuation and $25 million in revenue, thanks to a strong Gen Z fanbase and creative product design.

25. Florence by Mills by Millie Bobby Brown, aimed at teens and young adults, is valued at $50 million and made $20 million in 2024 sales.

Consumer Spending and Purchasing Stats

It’s no secret that people love to splurge on beauty products, but what exactly are they buying?

How often are they shopping?

Which products are becoming must-haves for different age groups and lifestyles?

Below are the beauty industry stats that break down how consumers are spending their money and what that says about the evolving world of beauty.

26. The average American spends about $182.30 on beauty products in total, with women tending to pay more than men overall.

27. Women in the U.S. spend around $313 a month on beauty and cosmetics, which is noticeably higher than what men pay.

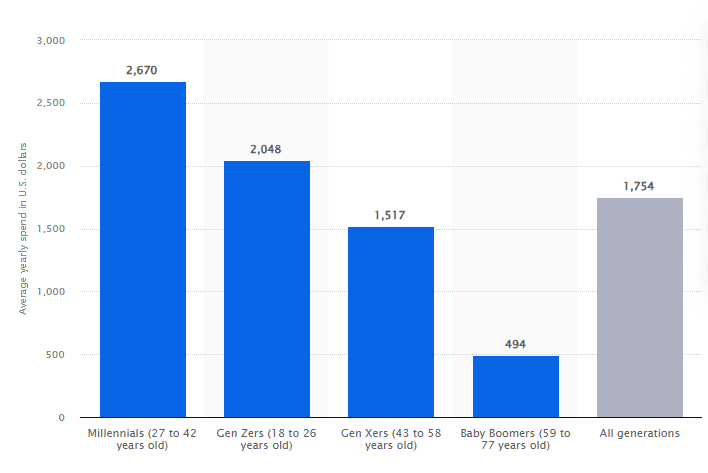

28. In 2023, millennials between the ages of 27 and 42 spent the most on beauty, averaging about $2,670 for the year. That’s more than any other age group in the U.S., making them the biggest spenders when it comes to beauty products.

Millennials spend the most on beauty products

29. In 2020, people spent over $483 billion globally on cosmetics, showing just how massive this industry really is.

30. Monthly beauty spending in the U.S. usually falls between $244 and $313, depending on age, habits, and lifestyle.

31. About 3 in 4 beauty shoppers respond positively to personalized product recommendations.

32. One in five women changed their skincare routine during the COVID-19 pandemic as more people focused on self-care at home.

33. 67% of beauty buyers say they rely on influencers to help them discover new products.

34. Millennial women aged 25 to 44 buy the most beauty products, making up 38% of all sales, followed by women aged 45 to 54, who make up 18%.

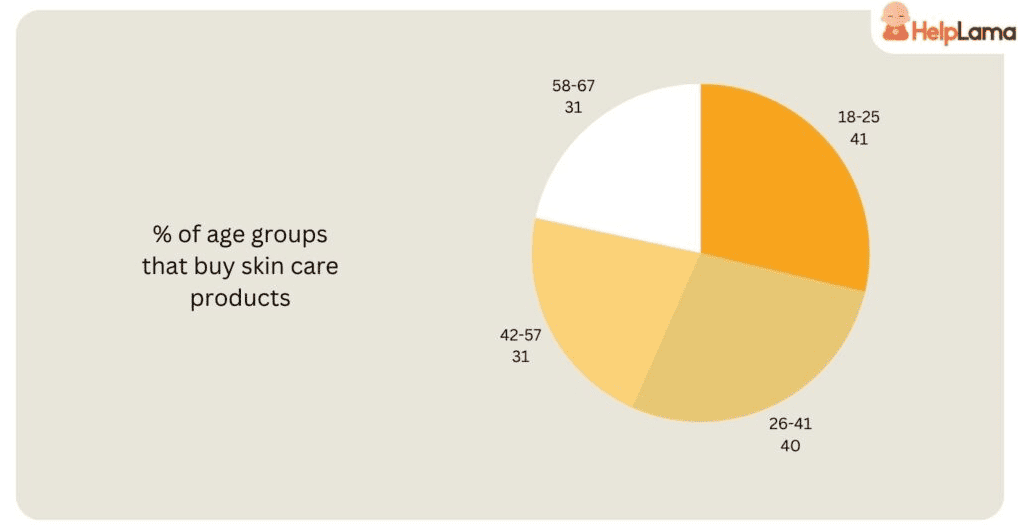

35. When it comes to skincare, 41% of Gen Z buyers purchase skincare regularly, just slightly ahead of millennials at 40%.

Percentage of age groups that buy skin care products

36. The main group buying skincare products is women aged 18 to 41, who account for over 40% of all skincare purchases.

37. On average, women spend $69 more per year than men on beauty products, highlighting the gender gap in beauty spending.

Technology and eCommerce in the Beauty Industry

From virtual try-ons to personalized skincare quizzes and AI-powered recommendations, the beauty industry is quickly becoming one of the most tech-savvy spaces out there.

As online stores take center stage and digital tools make the beauty experience more interactive and personal, it’s clear that the future of beauty is being shaped by innovation.

Here are the beauty industry stats that show just how much tech and eCommerce are transforming the game.

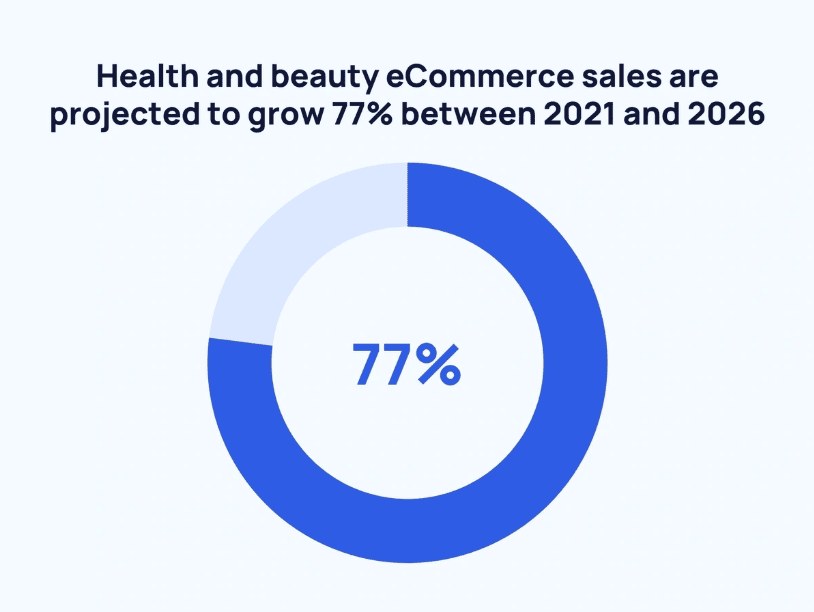

38. Health and beauty eCommerce sales are forecasted to grow by 77% between 2021 and 2026, with online beauty purchases possibly reaching $358.4 billion by 2026.

Beauty eCommerce sales will grow in future

39. Before the pandemic, about 85% of beauty products were bought in physical stores, and while online sales grew during lockdowns, they didn’t fully make up for the drop in in-store purchases, according to McKinsey.

40. Even with the convenience of online shopping, 46% of consumers still want to see beauty products in person before buying.

41. 18% of shoppers say they look for help from in-store professionals, which means brands need to find ways to offer that same kind of guidance online.

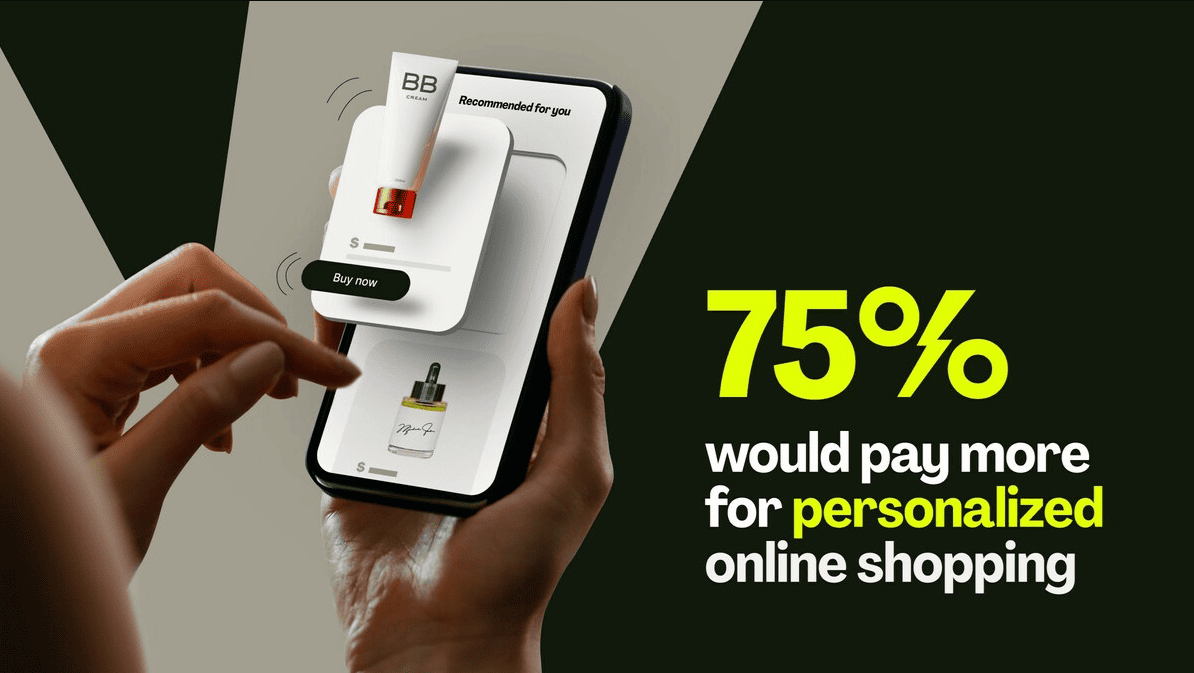

42. Shoppers who receive personalized recommendations are 75% more likely to make a purchase, showing how important customized shopping experiences have become.

Shoppers prefer personal recommendations when buying beauty products

43. About 3 out of 5 consumers prefer brands that feature user-generated content, like real photos and reviews, on their websites.

44. 6% of beauty shoppers use virtual or augmented reality tools when shopping for cosmetics, using tech to try on products before they buy.

45. Online cosmetic sales brought in $30.35 billion from the top 1,000 beauty retailers—almost $3 billion more than the year before, proving just how fast digital beauty shopping is growing.

Beauty Marketing and Social Media Stats

Have you ever discovered a beauty product through a YouTube tutorial, an Instagram reel, or a TikTok challenge?

If so, you’re not alone—social media is now one of the biggest drivers of beauty trends, shaping what’s hot, what sells, and who becomes the next big beauty influencer.

Below are the beauty industry stats that reveal how social media and marketing are fueling today’s beauty obsessions.

46. Social media helps 70% of people discover new beauty products, especially younger shoppers who spend a lot of time online.

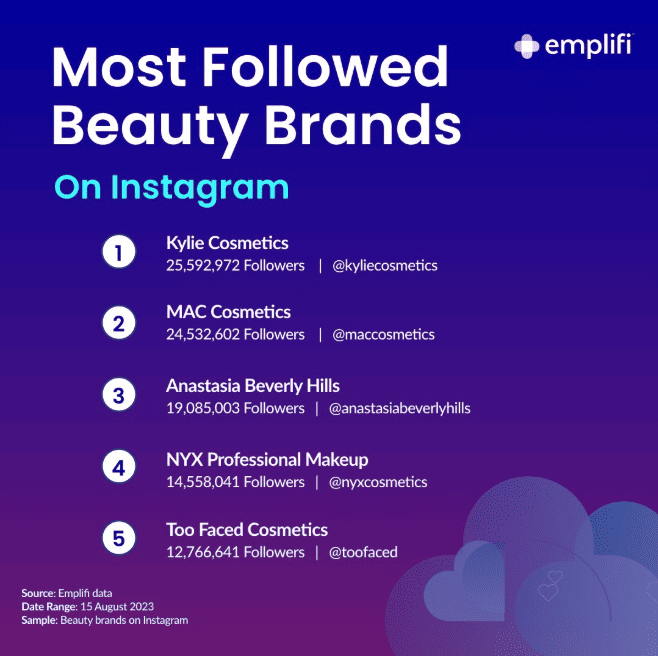

47. Kylie Cosmetics is the most followed beauty brand on Instagram, with a huge audience of around 25 million followers.

Most followed beauty brands on Instagram

47. One in three beauty buyers actively engage with brands on social platforms, whether that’s liking, commenting, or sharing. At the same time, marketing emails still work well, with a solid open rate of 11.5%, and the average cost-per-click for beauty ads is $1.68.

48. A Google study found that YouTube is the top place women aged 18–54 go for beauty content, with views of “makeup transformation” videos more than doubling every year.

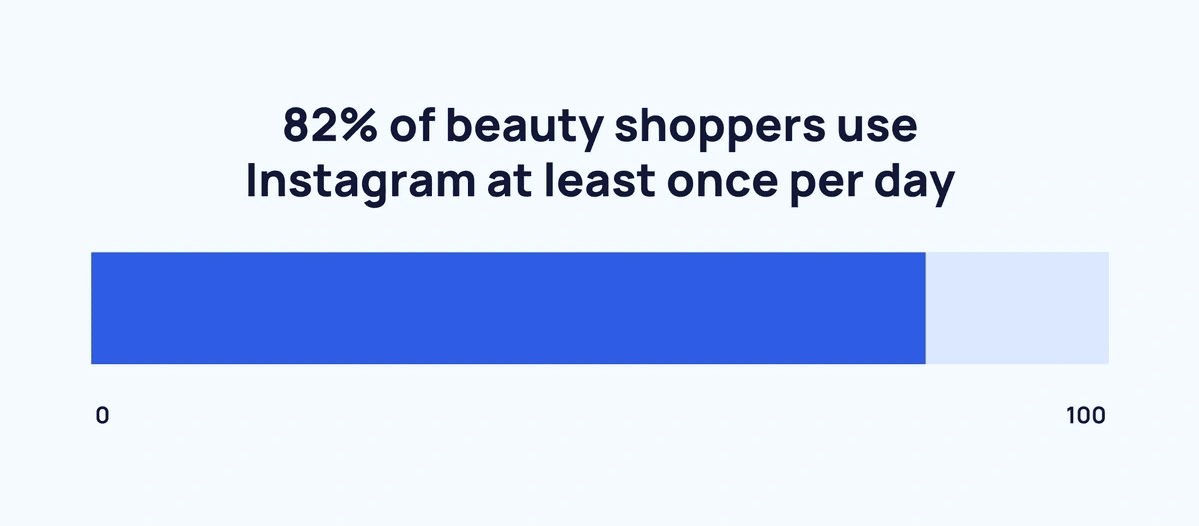

49. About 4 out of 5 beauty shoppers use Instagram every day, making it a key platform for beauty trends, tips, and product launches.

Almost all beauty shoppers use Instagram daily

50. Influencer marketing continues to be a major win for beauty brands, delivering a huge 600% return on investment, which is why it’s still such a popular strategy.

51. Roughly 2 in 3 beauty buyers say influencers help them discover new products, showing how much trust shoppers place in online creators.

52. When asked if they’d buy something an influencer recommended, 42% of shoppers said yes, while 43% weren’t sure, and 15% said no.

53. One in three beauty buyers actively engage with brands on social platforms, whether that’s liking, commenting, or sharing. At the same time, marketing emails still work well, with a solid open rate of 11.5%, and the average cost-per-click for beauty ads is $1.68.

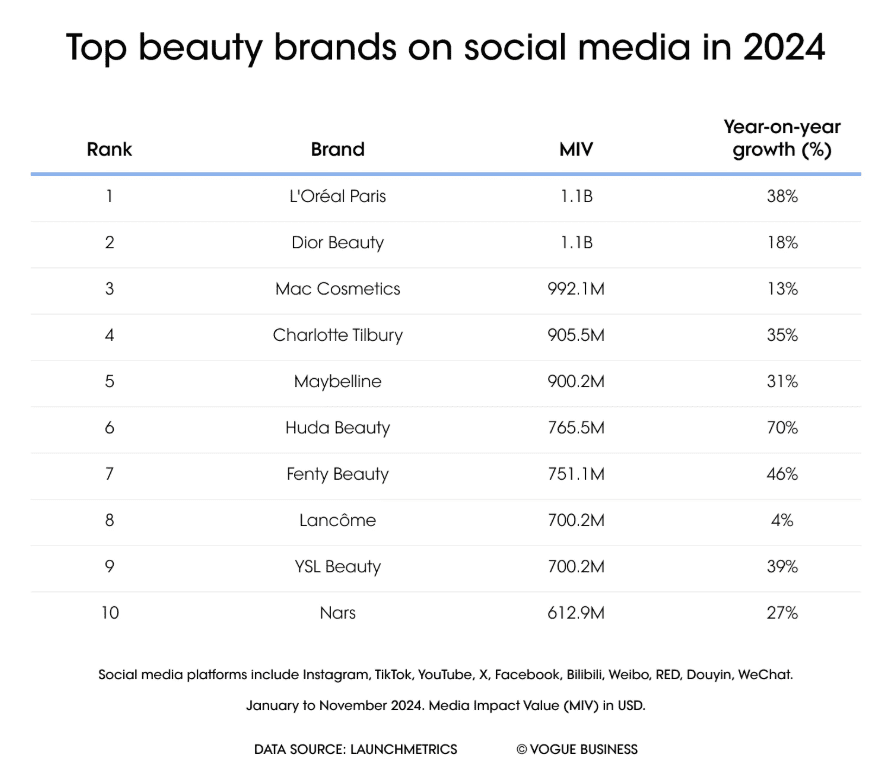

54. L’Oréal Paris leads in overall social media impact, followed by Dior and MAC Cosmetics, making them some of the most influential beauty brands online.

Top beauty brands on social media by Media Impact Value

Clean, Sustainable, and Organic Beauty Stats

More and more people are checking ingredient lists, asking how products are made, and choosing brands that care about the planet.

What was once a niche market is now a booming movement, with eco-conscious consumers pushing companies to be more transparent, ethical, and environmentally friendly.

Here are the beauty industry stats that show how clean, green, and organic beauty is no longer just a trend—it’s becoming the new standard.

55. Clean beauty products now bring in around $400 million in sales each year as more shoppers choose safer, gentler options.

56. Paraben-free beauty products are growing 80% faster than the rest of the market, showing how quickly demand for cleaner ingredients is rising.

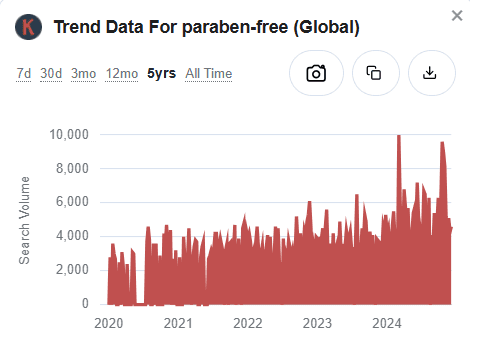

57. Interest in clean beauty is growing online too—searches for “paraben-free” have climbed steadily over the last five years, according to data from Keywords Everywhere.

58. Sustainability matters to today’s beauty buyers—17.6% say they look for eco-friendly brands, and 15.8% prefer products that come in recyclable packaging.

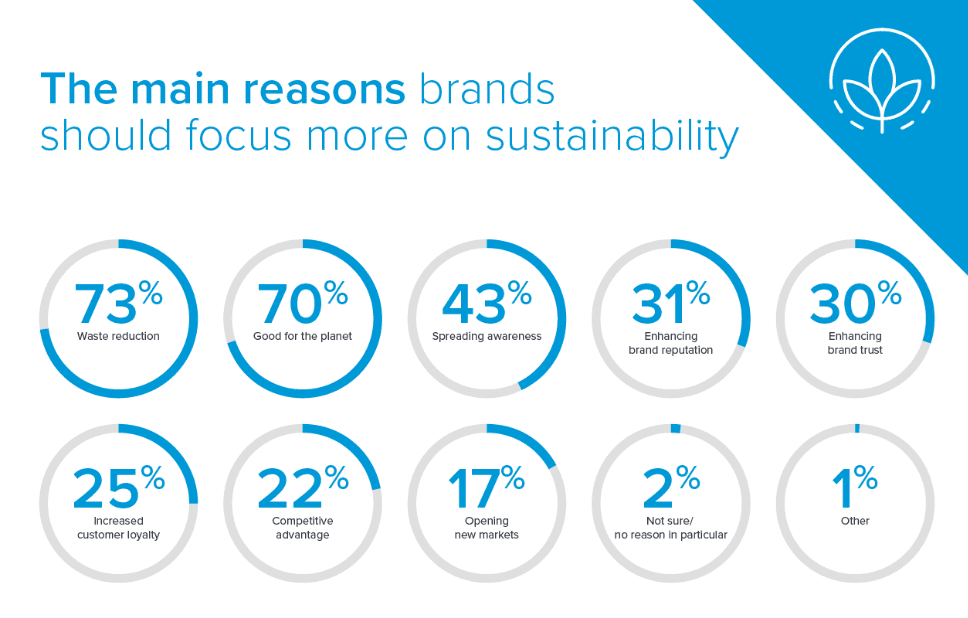

59. 85% of consumers say sustainability is important when picking a beauty brand, making it one of the top concerns in the shopping process.

60. Brands that focus on sustainability see 15% more customer loyalty, proving that being eco-conscious isn’t just good for the planet—it’s good for business, too.

Why brands should focus more on sustainability

61. Refillable and eco-friendly packaging is becoming more popular, with 30% of beauty brands offering sustainable packaging by 2024.

62. Natural and organic products now make up 12% of the entire beauty market, and they’re growing steadily at about 10% per year.

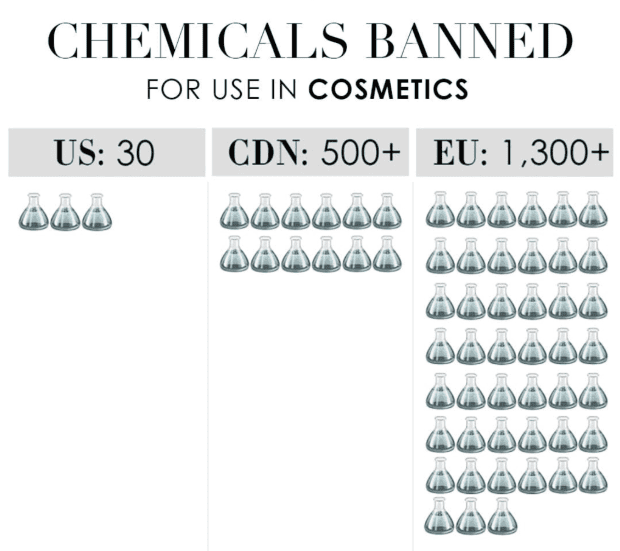

63. The European Union is much stricter about beauty product ingredients—they’ve banned 1,680 ingredients, which is more than 150 times the number prohibited in the U.S.

Chemicals banned by EU, US, and CDN

Conclusion

The beauty industry continues to evolve, and the momentum shows no signs of slowing down.

From the rise of clean and sustainable products to the growing power of social media and eCommerce, brands today have more ways than ever to connect with customers and shape trends in real-time.

Personalized shopping experiences, tech-driven innovations, and shifting buying habits are pushing the industry into exciting new territory.

While major players still dominate the market, there’s plenty of space for new brands that understand what today’s shoppers want and how they want it.