The idea of a digital currency that wasn’t tied to any government or bank had been around for years, but it wasn’t until 2009 that Bitcoin brought that vision to life.

Early projects like Litecoin and Namecoin joined the space in the years that followed, slowly building a foundation for something much bigger.

By 2013, the crypto world had grown to include over 50 coins. Just a year later, that number had exploded to more than 500.

Today, well over 13,000 cryptocurrencies are in circulation, and the number keeps climbing.

So, how did this once-niche idea become a global phenomenon? And what do the numbers tell us about where it’s all going?

This article breaks down the latest number of cryptocurrencies stats to help you understand the current state of this fast-moving world.

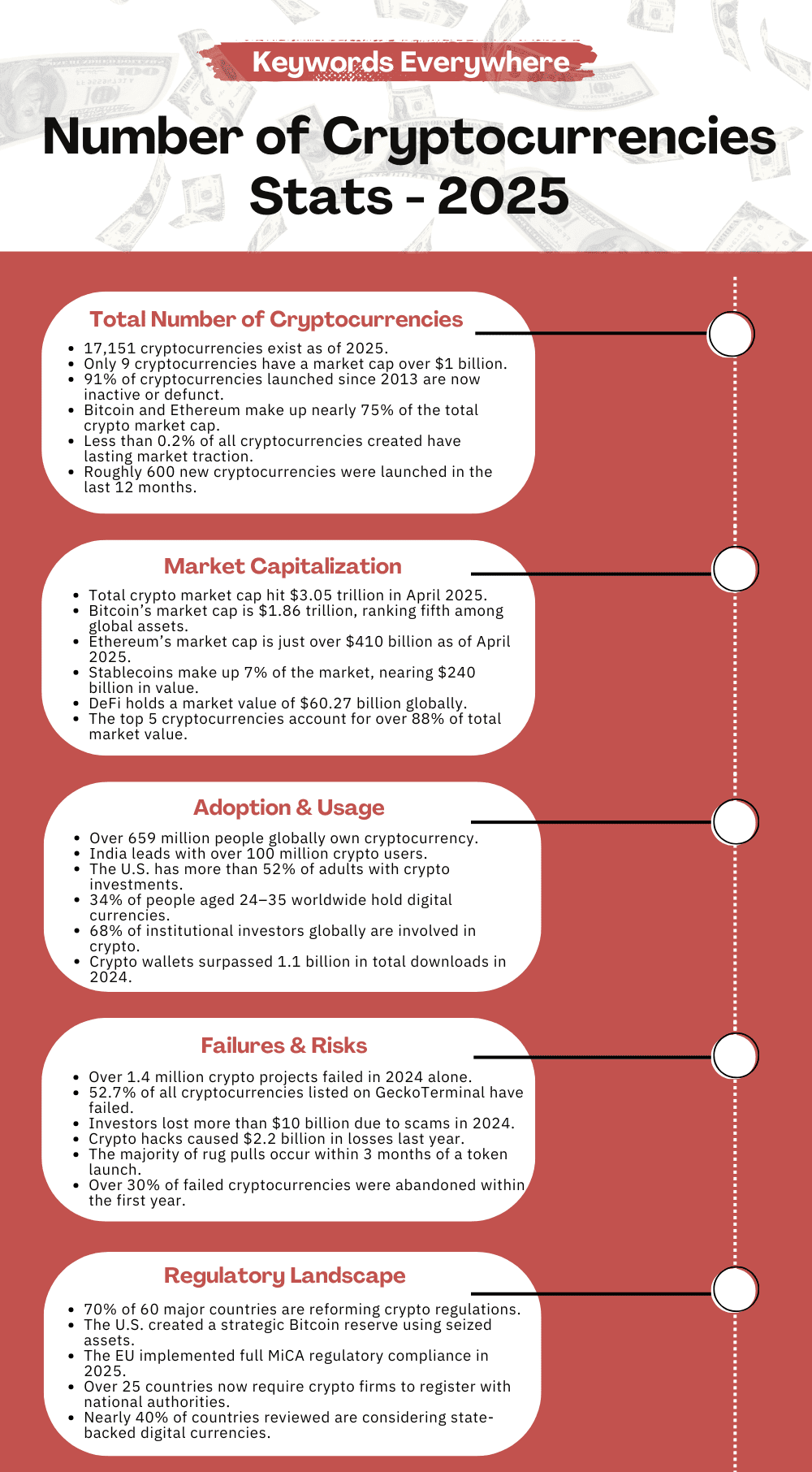

Total Number of Cryptocurrencies Stats

It’s hard to believe how far we’ve come, but there are now over 13,000 cryptocurrencies, each created with a dream of changing how we think about money, freedom, or the future.

What started with just one digital coin has now grown into a massive sea of ideas, experiments, and bold visions—some thriving, others fading—but all part of something bigger than we imagined.

Here are the total number of cryptocurrencies stats to help you understand how massive the world of cryptocurrencies has become.

1. As of April 2025, more than 17,000 active cryptocurrencies are in circulation.

2. It’s estimated that about 91% of the cryptocurrencies launched since 2013 are no longer active or have ceased operations.

3. The total market capitalization of all cryptocurrencies reached approximately $2.8 trillion in April 2025.

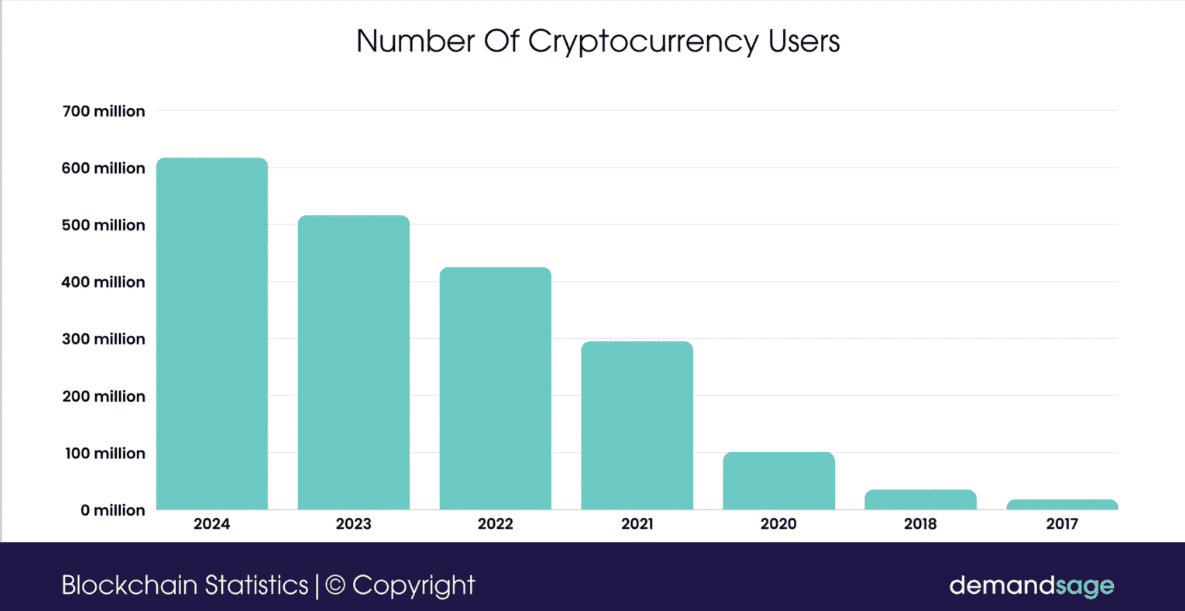

4. As of early 2024, approximately 562 million globally own cryptocurrencies, representing about 6.8% of the world population.

Number of cryptocurrency users

5. Global cryptocurrency trading volume is expected to exceed $108 trillion by the end of 2024, observing a solid 90% increase from 2022.

6. The United States currently leads the world in cryptocurrency market revenue, which is expected to hit $9.4 billion in 2025. The number of people using cryptocurrencies in the U.S. is projected to grow to 96.67 million by that same year.

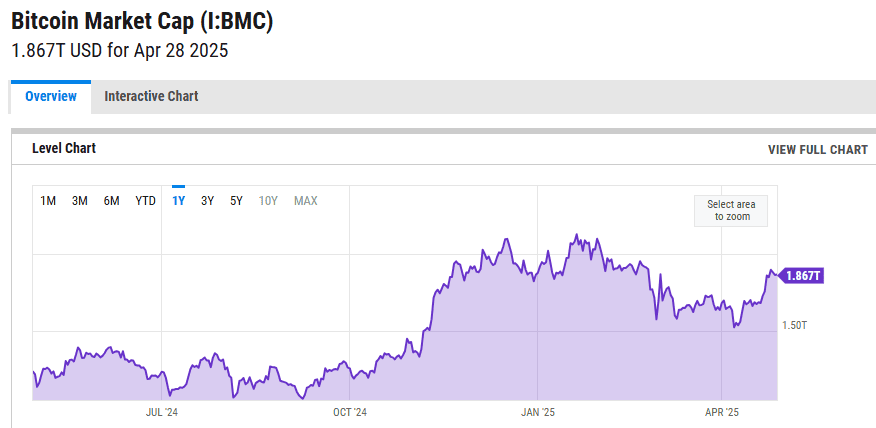

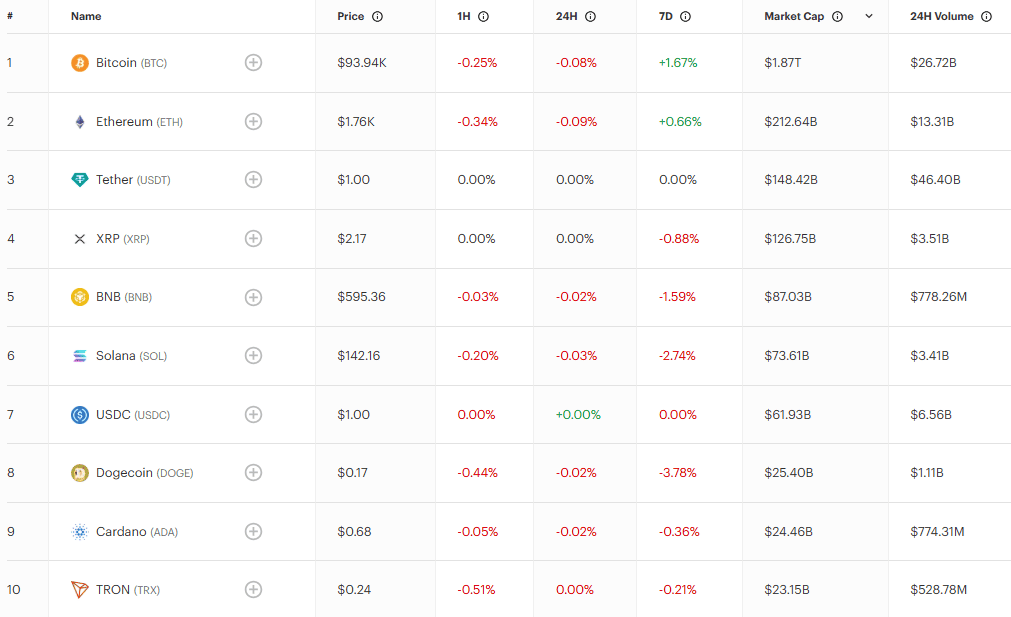

7. The market capitalization of Bitcoin is approx USD 1.861 trillion as of April 25, 2025. Analysts at Galaxy Research forecast Bitcoin’s price to exceed $185,000 by the fourth quarter of 2025.

Bitcoin market cap 2025

8. Both Tether (USDT) and USD Coin (USDC) are among the top 10 cryptocurrencies by market capitalization as of April 2025.

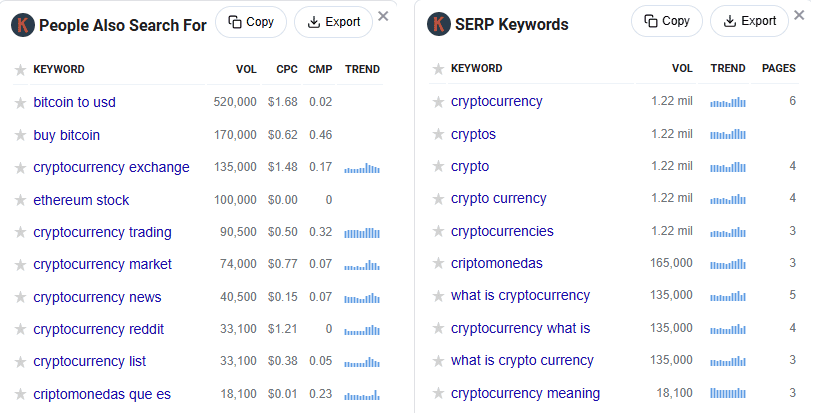

9. According to Keywords Everywhere, search terms related to cryptocurrency receive a high monthly search volume on Google, reflecting a surge in public interest and growing awareness of digital assets.

Growth of Cryptocurrencies Over the Years

The rise of cryptocurrency didn’t happen overnight, but it feels like the world changed in a flash when you look back.

From a few curious minds trading Bitcoin in forums to thousands of coins now traded across the globe, it’s been a wild ride fueled by hope, risk, and the belief that we could build something better than the system we knew.

And the story is far from over.

Here are the key cryptocurrency growth stats that show how cryptocurrency has grown year after year.

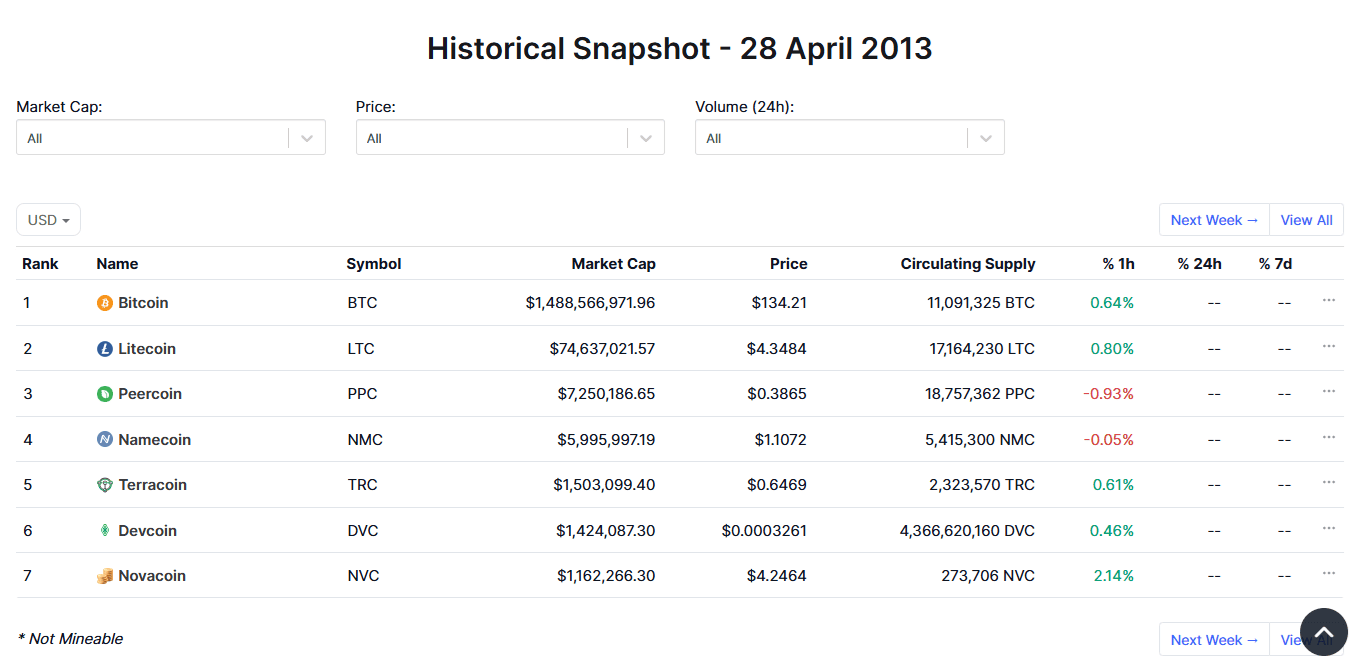

10. Back in April 2013, CoinMarketCap reported just seven cryptocurrencies. Bitcoin dominated the market with a cap of $1.49 billion, nearly 20 times higher than any other coin. Novacoin was at the bottom of the list with a market cap of just $1.16 million.

Seven cryptocurrencies in 2013

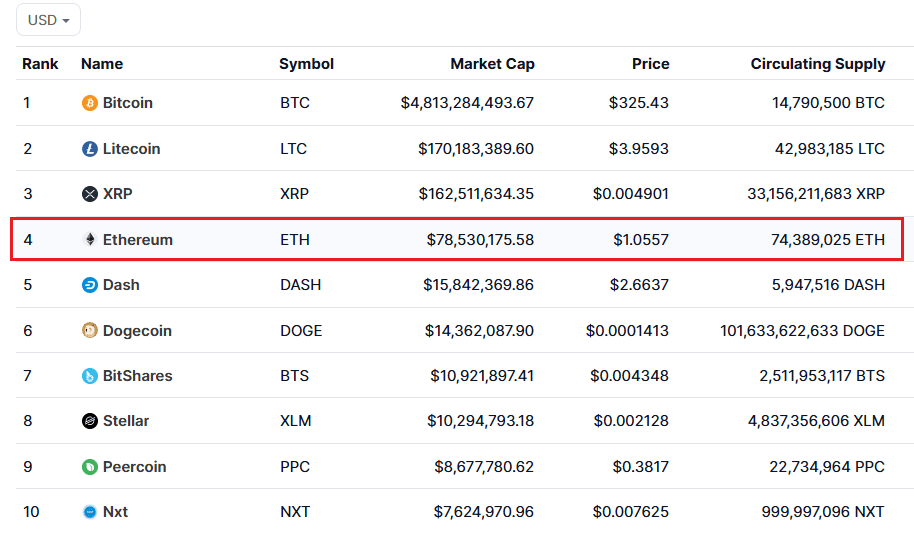

11. By November 2014, the number of cryptocurrencies had jumped to 513. Bitcoin still led the market with a valuation of around $5.13 billion.

12. Litecoin and Peercoin were the only other original coins that remained in the top ten, while newer names like XRP ($346.22 million) and Dogecoin ($23.30 million) entered the spotlight.

13. A year later, in November 2015, the market had grown slightly to 564 cryptocurrencies. Bitcoin’s market cap rose to over $5.5 billion. XRP, which had ranked second the previous year, saw its valuation dip to $144.18 million.

14. Seven of the top ten from 2014 were still holding strong, but Ethereum made a notable entrance with a market cap of $65.98 million.

Top 10 Cryptocurrencies in 2015

15. By the end of 2016, the total number of cryptocurrencies reached 663. Bitcoin’s price hit a three-year peak of nearly $900, almost tripling from where it stood a year before.

16. As of April 30, 2017, the crypto count had climbed to 789. Ethereum’s market cap surged over 1,000% in just four months, reaching $7.2 billion. XRP also made big gains, rising from about $232 million to $1.96 billion.

17. By the close of 2018, the number of cryptocurrencies had exploded to 2,073. Twelve of them had market caps exceeding $1 billion. Bitcoin remained on top with $67.48 billion, while Ethereum was third with $14.56 billion.

18. A report from November 2019 revealed that nearly 3,000 cryptocurrencies were circulating. Bitcoin’s market cap crossed the $100 billion threshold that year, ending at $134.57 billion. However, only nine cryptocurrencies had market caps over $1 billion.

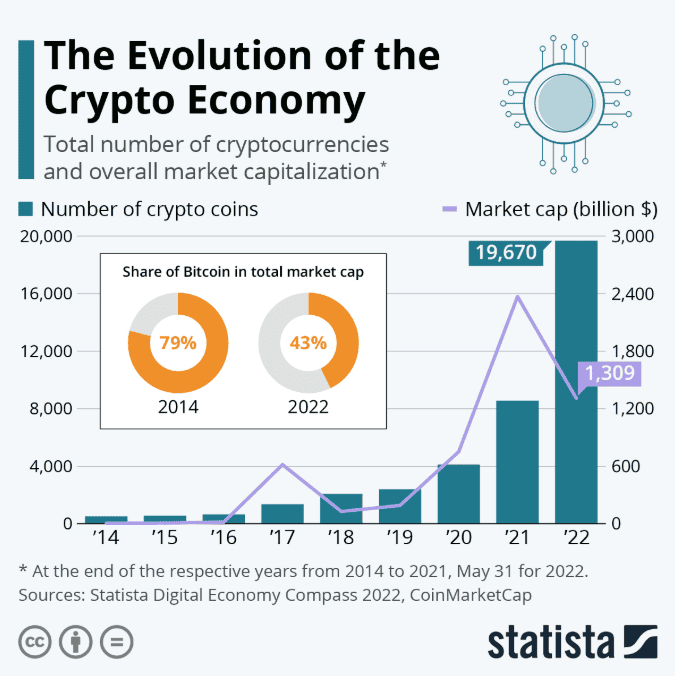

The evolution of the crypto economy

19. Despite the onset of the pandemic, crypto expansion continued. By April 2020, the number of tradable cryptocurrencies had reached 5,392.

20. The top 10 coins held a combined market cap of nearly $200 billion, with Bitcoin alone contributing over $140 billion. The number of billion-dollar coins increased to 28 by the end of 2020.

21. By 2024, the number of cryptocurrencies ballooned to 13,217. However, a significant portion of these were inactive or essentially worthless.

Cryptocurrency Market Capitalization Stats

Behind every number in the crypto market is a wave of belief—people investing, building, and hoping this new digital economy can offer more than just profit.

With trillions of dollars now flowing through crypto, it’s not just about technology anymore—it’s about trust, transformation, and a growing sense that something big is happening right under our feet.

Here are the cryptocurrency market cap stats that reveal just how much value is tied up in crypto today.

22. Total cryptocurrency market capitalization is $3.05 trillion as of April 30, 2025, marking a 29.65% increase from the previous year.

23. The market reached an all-time high of $3.91 trillion in mid-December 2024 before closing the year at $3.40 trillion.

24. Bitcoin continues to assert its dominance in the crypto market, with a market cap of approximately $1.861 trillion and a dominance rate of around 63%.

Cryptocurrency prices by market cap

25. Stablecoins currently represent about 7% of the total market, with a combined market cap nearing $240 billion.

26. As of April 30, 2025, the decentralized finance (DeFi) market is currently valued at $60.27 billion, showing a slight -0.10% change in the past 24 hours.

27. The DeFi category currently includes 146 coins, with top trending tokens like RAMP [OLD] (+36.82%) and Drift Protocol (+27.35%) seeing strong gains.

28. As of April 30, 2025, the artificial intelligence (AI) crypto market is valued at $18.50 billion, reflecting a +1.08% increase in the last 24 hours.

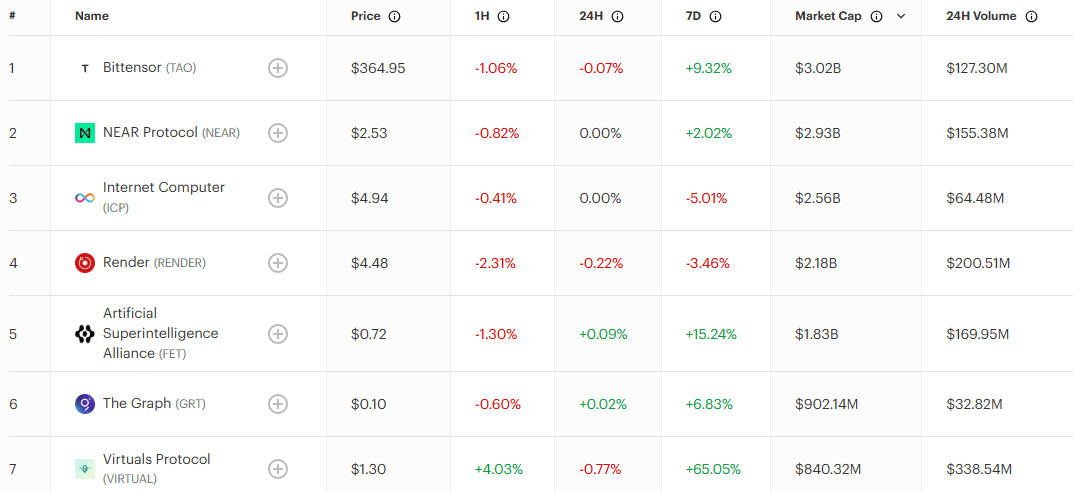

29. The AI category includes 57 AI-related cryptocurrencies, with trending projects such as Akash Network (+15.92%) gaining traction, while Spectral saw a drop of -12.38%. The market cap of Bittensor (top performer) has fallen by -7.43%, and NEAR Protocol (number second) is down -6.33% over the past 24 hours.

Top 7 AI coins by market cap

Cryptocurrency Adoption and Usage Stats

More and more people are turning to crypto not because it’s trendy, but because they’re searching for control, for fairness, and sometimes for a second chance.

From young investors in big cities to families in places where traditional banks fall short, crypto is becoming a lifeline, a learning curve, and a leap of faith all at once—and its reach keeps growing.

Here are the latest stats that show who’s using crypto and how fast adoption is spreading.

30. Approximately 659 million people worldwide own some form of cryptocurrency, representing about 11.9% of the 5.56 billion internet users globally.

31. Analysts predict that global crypto adoption could reach 8% of the world’s population by the end of 2025, driven by institutional interest and economic factors.

32. India led the world in crypto adoption for the second consecutive year despite regulatory challenges. Other countries with high adoption rates include Nigeria, Vietnam, Indonesia, and the United States.

Top crypto adoption by countries

33. Approximately 34% of individuals aged 24 to 35 globally own cryptocurrencies, making them the largest demographic group of crypto holders.

34. Gen Z (ages 18–27) represents 13% of crypto investors, indicating growing interest among younger adults. Gen X (ages 44–59) accounts for 20% of crypto investors, while Baby Boomers (ages 60 and above) make up 10%.

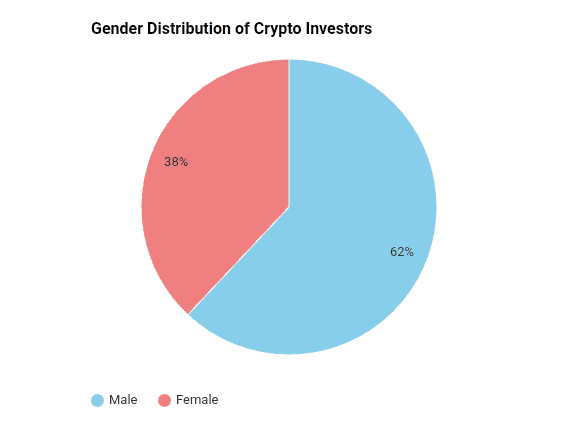

35. Approximately 62% of crypto investors are male, while 38% are female, indicating a persistent gender gap in cryptocurrency investment.

Gender distribution of crypto owners

36. In Bitcoin ownership specifically, 70% are men and 30% are women, showing a slight improvement in female participation over time.

37. In the United States, over 52% of adults have purchased cryptocurrency.

38. Stablecoins accounted for 32% of daily crypto usage in 2024, second only to decentralized finance (DeFi) applications, which made up 34%.

39. The number of cryptocurrency millionaires nearly doubled in 2024, with 172,300 individuals holding over $1 million in crypto assets.

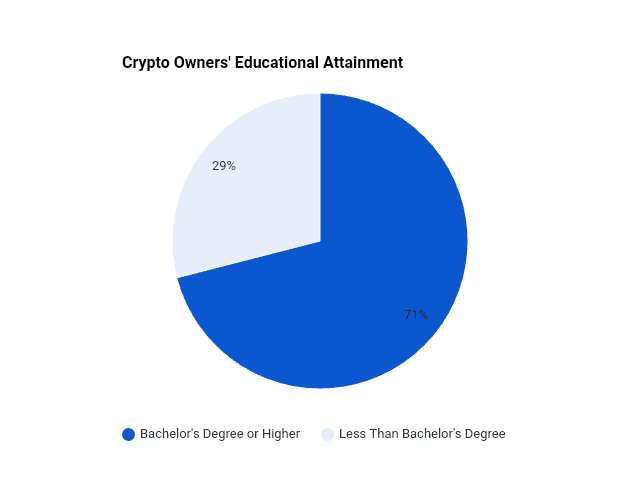

40. About 71% of crypto owners hold a Bachelor’s degree or higher, suggesting that higher education correlates with cryptocurrency adoption.

Crypto owners’ educational attainment

41. Specifically for Bitcoin owners, 35% have a Bachelor’s degree, and 25% possess a postgraduate degree, indicating a well-educated user base.

42. 36% of crypto owners earn $100,000 or more annually, highlighting significant participation from higher-income individuals.

43. Approximately 68% of institutional investors have invested in digital assets globally.

44. The adoption of cryptocurrency as mode of payment grew by 55% in 2023, with businesses increasingly accepting Bitcoin and stablecoins.

45. The crypto remittance market is booming, with cross-border payments via digital assets estimated at $30 billion annually.

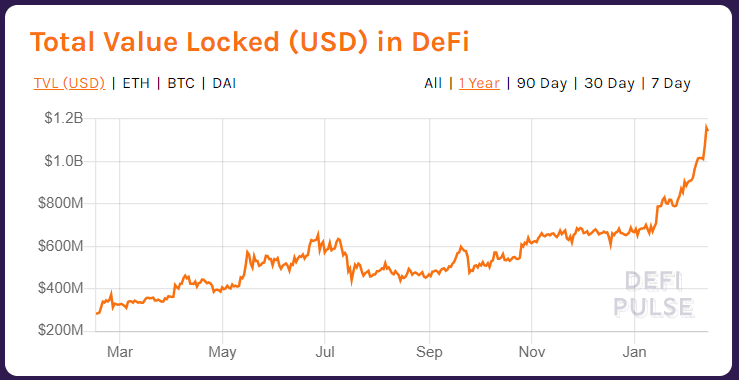

46. The decentralized finance (DeFi) sector has experienced significant growth, with the total value locked (TVL) in DeFi protocols reaching approximately $129 billion.

Total value locked in DeFi

Cryptocurrency Failures and Risks Stats

People make thousands of dollars through crypto, but it’s not always sunshine and rainbows.

The crypto world is full of risks—scams, collapses, and broken promises—but that doesn’t stop people from trying again.

These failures aren’t just cautionary tales; they’re reminders of the cost of innovation and the importance of moving forward wisely.

Here are the cryptocurrency stats that expose the risks and realities many people overlook:

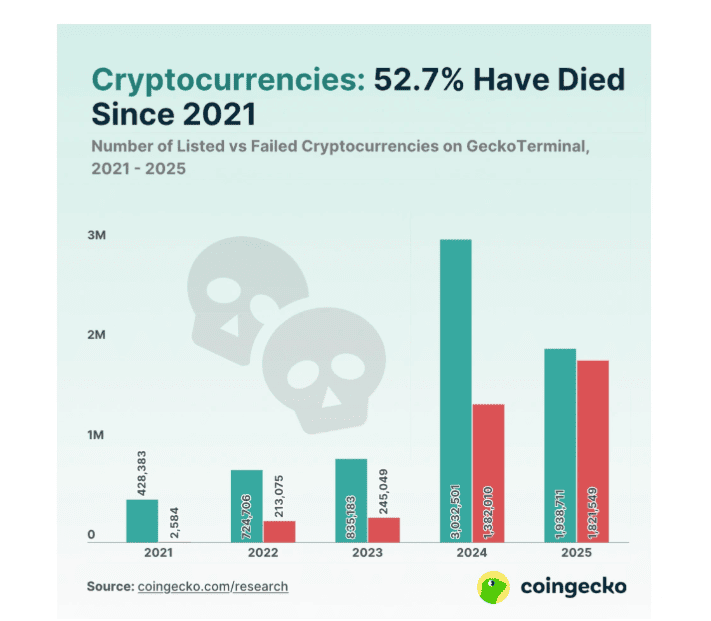

47. Over 1.4 million cryptocurrency projects failed in 2024, accounting for 37.7% of all failures in the past five years. This surge coincided with a record 3 million new projects launched that year.

48. 52.7% of all cryptocurrencies listed on GeckoTerminal have failed, with the majority of these failures occurring during 2024 and early 2025.

More than half cryptocurrencies have died since 2021

49. A study by CoinGecko reveals that out of 24,000+ cryptocurrencies listed since 2014, more than 14,000 have become inactive or failed.

50. Approximately 70% of the 11,000+ tokens launched during the 2020–2021 bull run are now defunct, primarily due to lack of utility, developer abandonment, or scams.

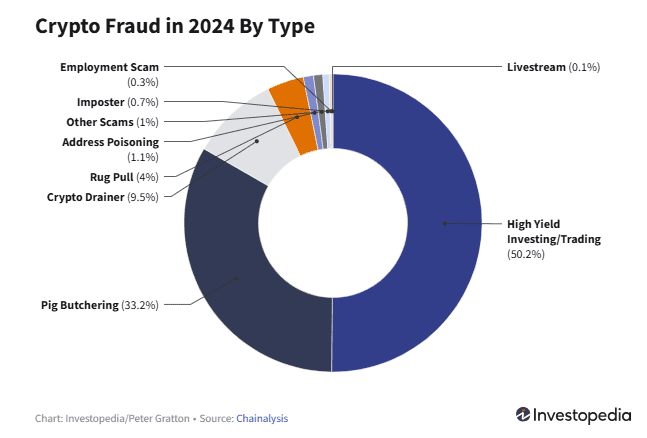

51. Investors worldwide lost over $10 billion due to various crypto scams and security breaches in 2024. Common frauds include schemes exploiting a lack of knowledge and greed and hacking into exchange and wallet infrastructures.

Crypto fraud in 2024 by type

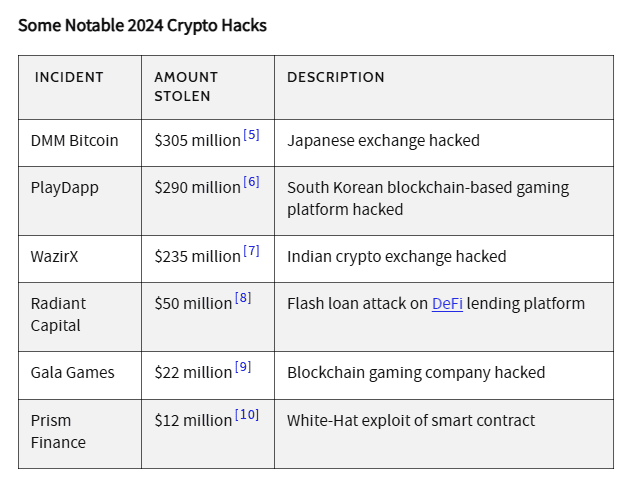

52. According to Chainalysis, the crypto industry suffered $2.2 billion in losses due to hacks in 2024, marking a 21% increase from the previous year. There were 303 recorded incidents, with North Korean-linked hackers responsible for $1.3 billion of these losses.

53. North Korea has been identified as a major sponsor of crypto hacks, responsible for over $6 billion in theft since 2017.

54. Indian exchange WazirX was hacked on July 18, 2024, leading to a loss of approximately $234.9 million. The attack was attributed to North Korea’s Lazarus Group.

Notable 2024 crypto hacks

55. Approximately 63% of Americans express little to no confidence in the safety and reliability of cryptocurrency investment methods.

56. Following the Bitcoin halving on April 19, 2024, the cryptocurrency experienced its worst post-halving performance, increasing by only 43.4%, significantly below gains from previous halvings.

57. Advancements in quantum computing pose potential risks to current cryptographic standards. Analysts estimate that about 25% of Bitcoins could be vulnerable to quantum attacks in the near future.

Cryptocurrency Regulatory Landscape

As crypto grows, so does the pushback. Around the world, leaders are struggling to understand it, control it, or completely shut it down.

For every country that opens the door to digital assets, another slams it shut.

But behind the headlines are real people—builders, believers, and everyday users—caught between the rules and the revolution, just trying to figure out what comes next.

Here are the important stats showing how regulation is shaping the future of cryptocurrency.

58. Among 60 countries analyzed, over 70% are implementing big changes to their cryptocurrency regulatory frameworks, signaling a global shift towards more structured oversight.

59. Of the countries reviewed, 33 have legalized cryptocurrency usage, while 27 have imposed partial or general bans.

60. In March 2025, the U.S. established a strategic Bitcoin reserve composed of seized digital assets, aiming to diversify national holdings without any direct market purchases. This move could influence other nations to consider similar reserves.

61. The Markets in Crypto-Assets (MiCA) regulation has been fully implemented, offering a unified framework for crypto assets across EU member states. It offers a more safe and transparent environment for digital asset operations.

62. Japan continues to lead in crypto regulation, with the Financial Services Agency streamlining processes for registering cryptocurrency exchanges and implementing comprehensive stablecoin regulations.

63. Despite the global momentum, Australia risks falling behind due to a lack of proactive regulatory measures, potentially impacting its competitiveness in the burgeoning crypto industry.

64. Despite regulatory discouragement, both India and China show very strong cryptocurrency adoption rates (with India ranking number one in crypto adoption charts).

65. Advanced economies are increasingly implementing regulations across four key areas: taxation, anti-money laundering (AML), consumer protection, and licensing. However, only 11% of middle-income countries have comprehensive regulations in all these categories, and none of the low-income countries do.

Conclusion

That wraps up the current state of cryptocurrency, especially when it comes to adoption, growth, risks, and regulation.

Crypto has firmly planted itself in the global conversation. And while it’s had its ups and downs, the overall trend is moving forward, with innovation driving the way.

Bitcoin still leads the pack, but altcoins, DeFi, AI tokens, and other new categories are quickly gaining ground.

The future of crypto is still being written—one block, one breakthrough, and one bold step at a time.