eCommerce is booming like never before. With millions of people shopping daily on the internet, it’s become a main player in driving economies and shaping global markets.

But as eCommerce flourishes, so does the darker side—eCommerce fraud.

This type of fraud usually happens during online transactions, where scammers exploit unsuspecting shoppers or businesses.

They might impersonate a brand, run fake websites, or pose as customer support to trick people into handing over money or any kind of sensitive information.

In this blog, we’ll dive into the latest eCommerce fraud stats and trends from different countries and break down the most common types of scams you should watch out for.

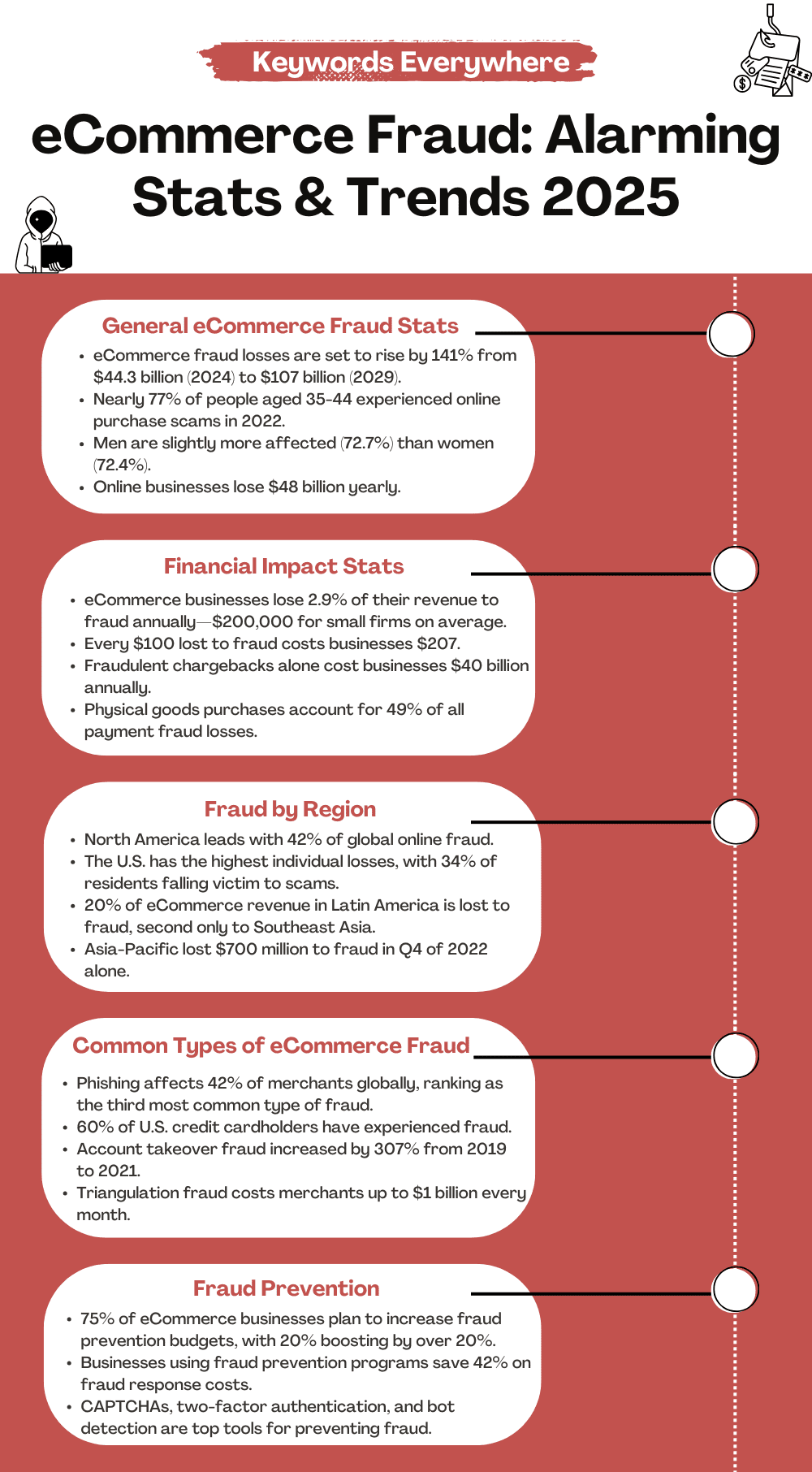

General eCommerce Fraud Stats

The global impact of eCommerce fraud is massive and it continues to grow.

Recent numbers show that this problem costs businesses billions of dollars annually, affecting online retailers of every size and industry.

Whether it’s a small local shop or a global company, no one is completely safe from these kind of scams.

To give you a clearer picture, here are some key eCommerce fraud stats that show just how widespread and serious the issue has become:

1. A recent study by Juniper Research, a leader in fintech insights, shows that eCommerce fraud is set to increase. Losses are expected to climb from $44.3 billion in 2024 to $107 billion by 2029—a massive 141% jump.

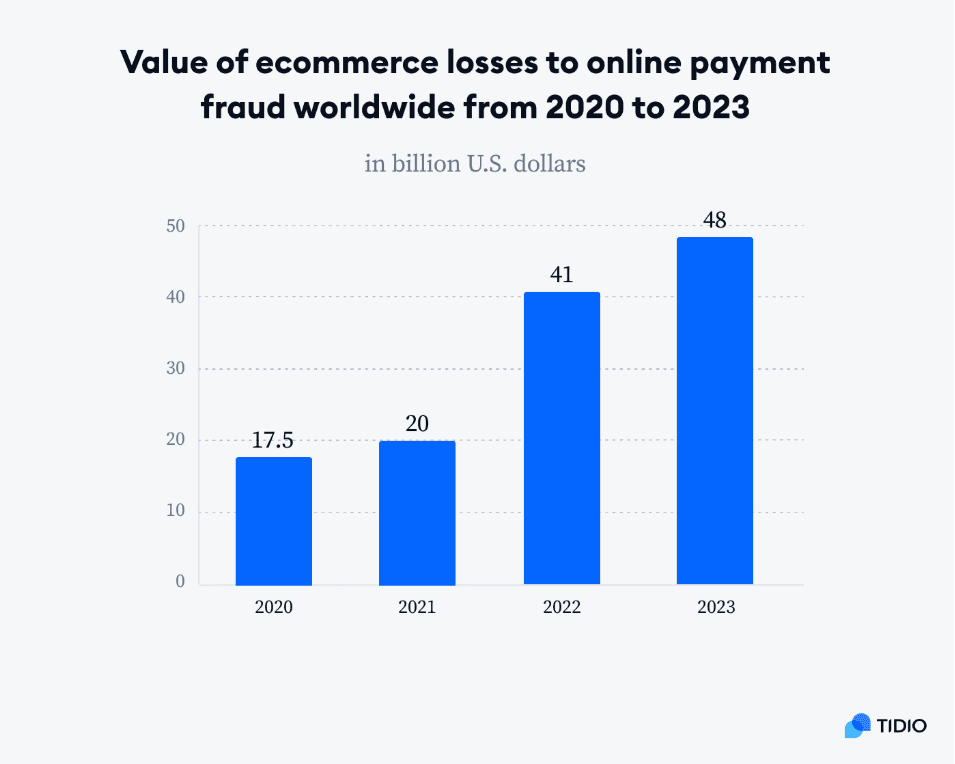

2. Right now, online businesses are losing around $48 billion to fraud each year. Over the past year alone, global losses have shot up by 16%. A big reason? The rise of new payment methods like Buy Now and Pay Later has opened doors for scammers.

Value of ecommerce losses due to online payment fraud

3. Juniper also predicts that between 2023 and 2027, businesses could lose over $343 billion to online payment fraud. To put that in perspective, it’s more than 350% of what Apple made in net income during 2021!

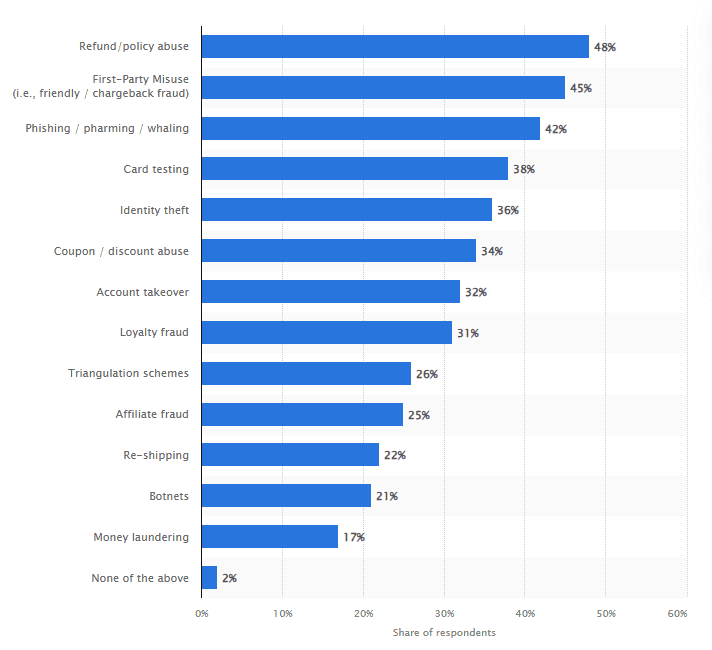

4. In 2024, refund and policy abuse topped the charts as the most common type of fraud, impacting nearly half of online merchants. Close behind was “friendly fraud,” or first-party misuse, which affected 45% of merchants.

5. When it comes to victims, people aged 35-44 were hit the hardest, with over 77% losing money to online purchase scams in 2022. Older adults, particularly those 55 and above, were slightly better at avoiding losses, with less than 75% reporting financial hits.

Age group of identity theft victims

6. Men are slightly more vulnerable to eCommerce scams than women. About 72.7% of men reported losing money, compared to 72.4% of women.

7. On a positive note, the global market for fraud detection and prevention is booming. It’s valued at $57.51 billion in 2024, up from $40.15 billion in 2022. By 2030, it’s projected to reach an impressive $186.82 billion, growing at 21.45% annually.

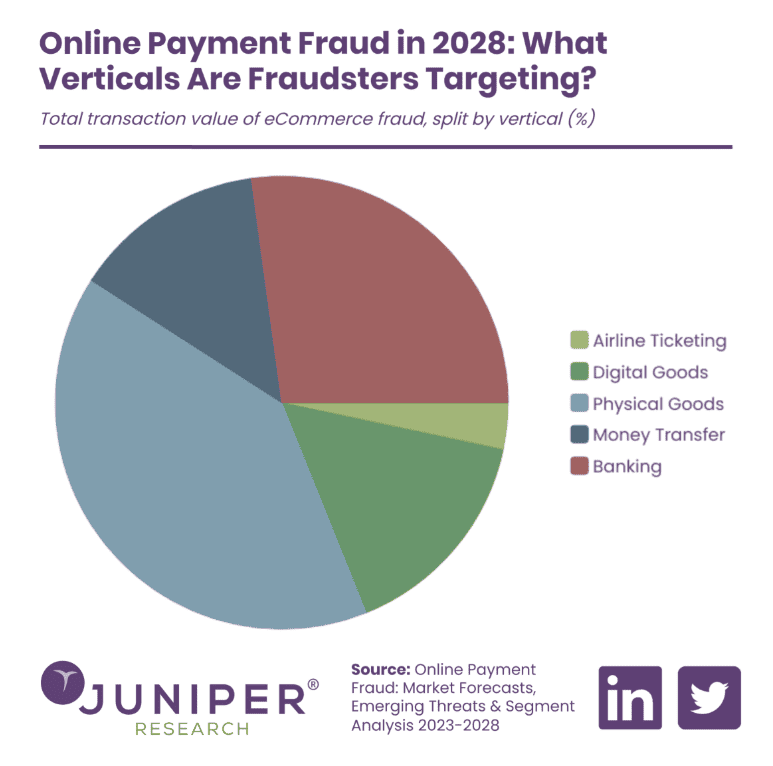

8. One of the biggest sources of losses is physical goods purchases. These alone are expected to account for 49% of all online payment fraud losses over the next five years, with a predicted growth of 110%.

Sources of losses for online payment fraud

eCommerce Fraud Financial and Market Stats

The eCommerce world is hit massively by fraud every year, and billions of dollars are lost in the process.

And it’s not just the value of the fraudulent orders that businesses are losing—there’s much more to it.

Add in shipping costs, chargebacks, and processing fees, and the financial burden multiplies very quickly.

Here are some eCommerce fraud stats that talk about the financial impact of this kind of fraud:

9. In 2022, eCommerce companies lost about 2.9% of their global revenue to fraud. While that’s a slight improvement from the 3.6% lost the previous year, we’re sure that it’s still a big hit.

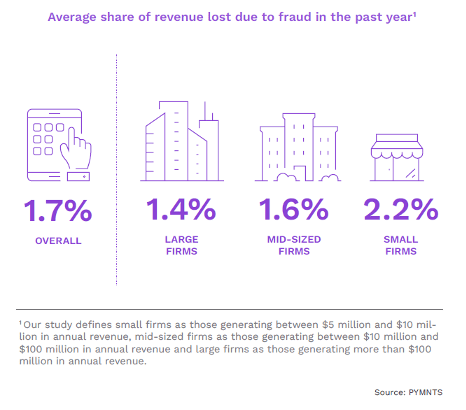

10. Smaller businesses take a harder hit from fraud than larger ones, losing 57% more revenue on average. For small firms, this means an annual loss of around 2.2% of their revenue—or roughly $200,000. Mid-sized companies also feel the pinch, with average losses of 1.6% of their revenue, compared to the 1.4% lost by larger firms.

Average share of revenue lost due to fraud in 2023

11. On average, eCommerce merchants spend 11% of their yearly revenue managing fraud. Small businesses and large companies spend even more—about 12%—while mid-sized companies spend around 10%.

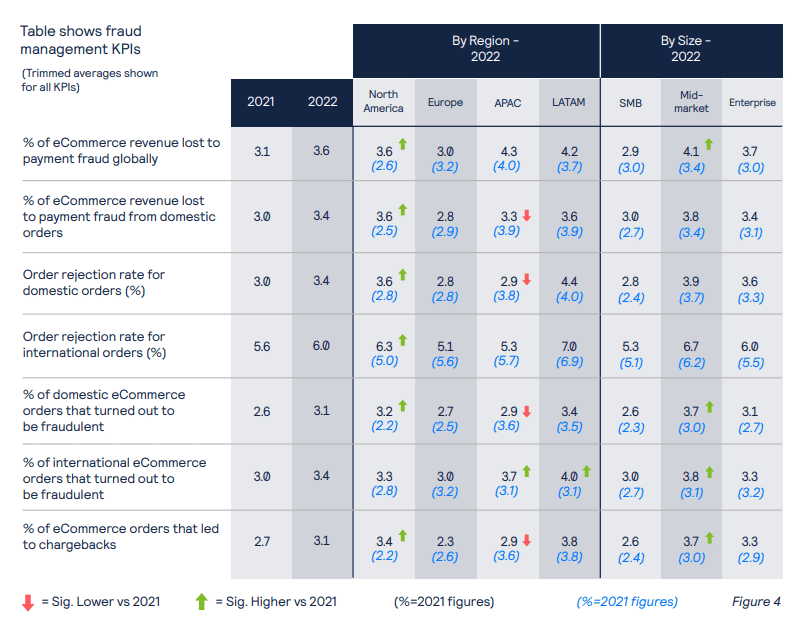

12. Around 2.6% of domestic eCommerce orders were fraudulent in 2022, compared to 3.1% in 2021. For international orders, 3.0% were fraudulent, down from 3.4% the year before.

Global fraud and payment report 2022

13. A study by Signifyd in 2023 found that for every $100 lost to fraud, businesses actually lose $207 once wholesale costs, fulfillment, shipping, chargebacks, and processing fees are factored in.

14. When it comes to payment methods, wire transfers are the riskiest, with consumers losing an average of $439 million to fraud. Credit card and gift card payments also took big hits, losing $125 million and $103 million, respectively.

15. The median loss per online purchase scam was $114 in 2022, up from $101 in 2021 and $96 the year before. These losses had decreased after 2017 but surged again during the pandemic.

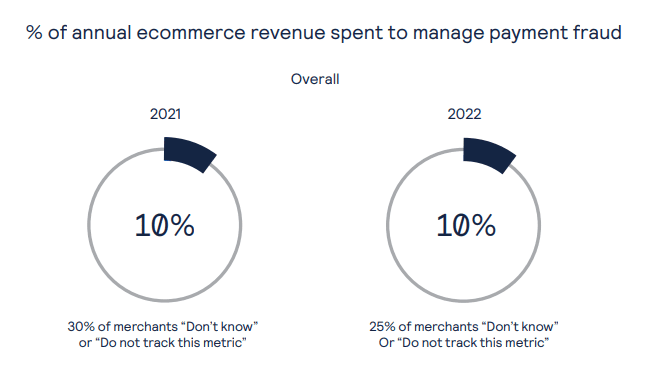

16. Fraudulent chargebacks alone cost businesses a jaw-dropping $40 billion annually. It’s no surprise, then, that eCommerce companies dedicate such a big portion of their revenue (10%) to fraud protection.

Percentage of annual eCommerce revenue spent to manage fraud

eCommerce Fraud Location Stats

Where are all these fraudulent transactions taking place?

Unsurprisingly, the United States leads the pack with the highest number of consumers affected by fraud.

This isn’t shocking at all, given that the country has also been a major target of high-profile cyber-attacks over the years.

But fraud isn’t limited to the US—it’s a global issue affecting businesses and consumers everywhere in the world.

Let’s take a closer look at some important eCommerce fraud stats that show how much fraud is happening in different regions:

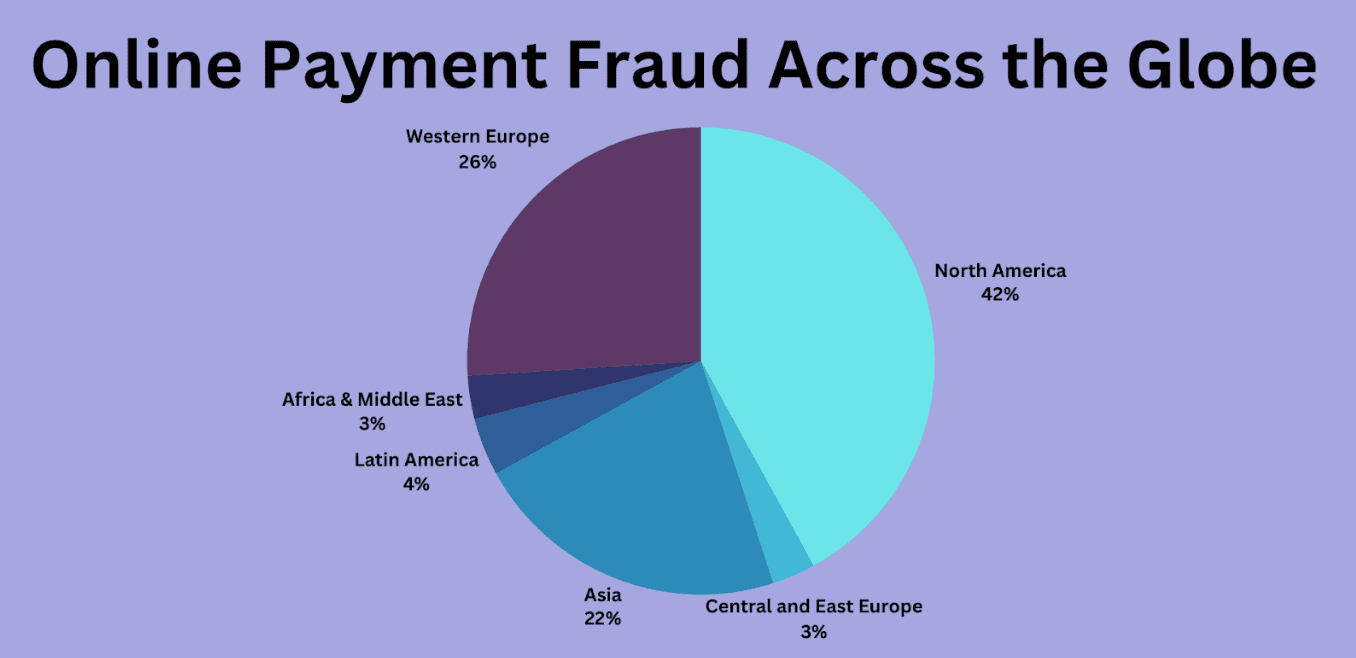

17. North America is leading the pack when it comes to eCommerce fraud. In 2023, over 42% of all online fraud worldwide came from this region.

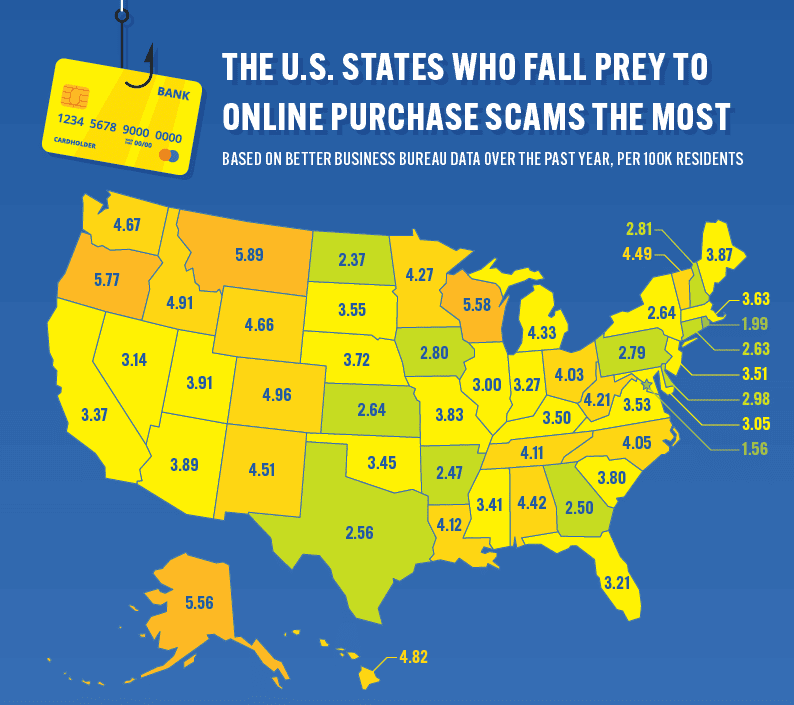

18. The US stands out as the most fraud-prone country, with 34% of people saying they’ve fallen victim to scams—and chances are that number is even higher now.

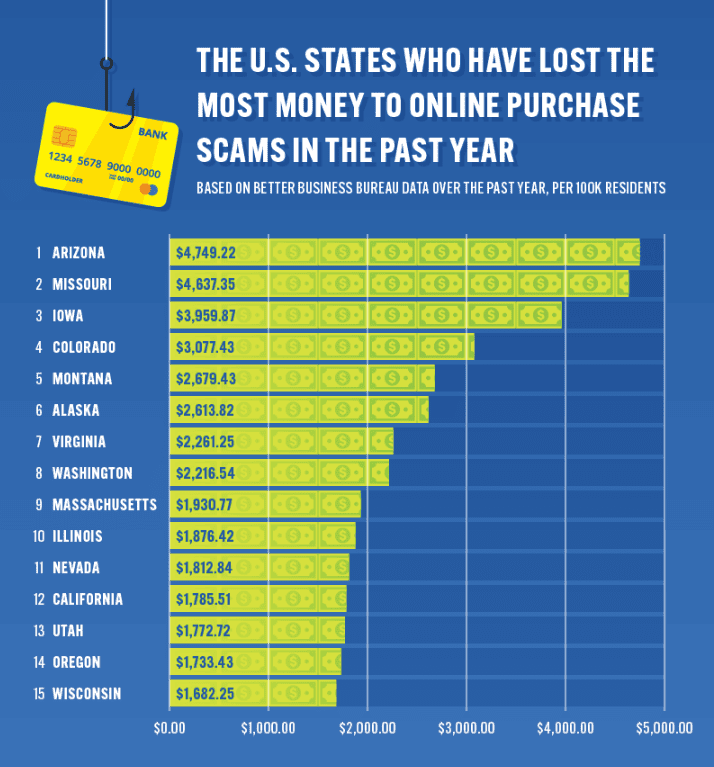

US states with the most online purchase scams

19. In Montana, things were rough between 2021 and 2022. It had the highest rate of online purchase scams, with residents losing about $2,700 for every 100,000 people.

20. Over the past year, Arizona saw the biggest losses to online scammers, with residents losing an average of $4,749 per 100,000 people.

21. Missouri wasn’t far behind, with losses slightly over $4,600 per 100,000. Scammers there have even stooped to pretending to sell puppies to trick people.

Money lost to scammers in the US

22. In 2022, about one in four online retailers in Mexico noticed more “friendly fraud” (where buyers dispute legitimate purchases). In Germany, nearly a third of merchants said they saw an increase in friendly fraud, and half reported more cases of promotion abuse.

23. Canada and Australia also faced major challenges, with around 70% of online merchants reporting a rise in payment fraud.

24. In Latin America, eCommerce is growing, but so is fraud. Around 20% of eCommerce revenue in this region is believed to be lost to scams, making it second only to Southeast Asia in fraud levels.

Online payment fraud by region

25. A 2022 survey found that 3.7% of all eCommerce orders in Latin America were fraudulent. While Latin America led in domestic fraud, Asia-Pacific topped the charts for fraud involving international orders.

26. Asia-Pacific, the biggest eCommerce market globally, lost a staggering $700 million to online fraud in just the last quarter of 2022.

Types of eCommerce Fraud Stats

The methods for committing eCommerce fraud are always changing. Fraudsters use various strategies like the ones below to deceive both shoppers and businesses for their own gain.

Phishing

Phishing uses phone calls, text messages, or fake websites to trick people into giving their personal information, which scammers then use for fraud transactions.

In these attacks, the scammer pretends to be a trusted person or a representative of a familiar brand, convincing the victim to act—like clicking on a link.

Once the link is clicked, it can install ransomware that secretly tracks the victim’s activity and steals all their sensitive data.

27. In 2024, phishing was the third most common type of fraud faced by online merchants globally, affecting 42% of them, according to Statista.

Most common types of fraud experienced by online merchants in 2024

28. When it comes to fraud spikes during the COVID-19 pandemic, account takeover (ATO) attacks saw the biggest jump, increasing by 282%. Phishing websites followed with a 250% rise, fraud attempt rates went up by 100%, and fraud losses increased by 87%.

29. Google also reported a huge 350% surge in phishing websites using coronavirus-related keywords in March 2020.

Credit Card Fraud

Credit card fraud happens when criminals use stolen or fake credit card details to make unauthorized online purchases.

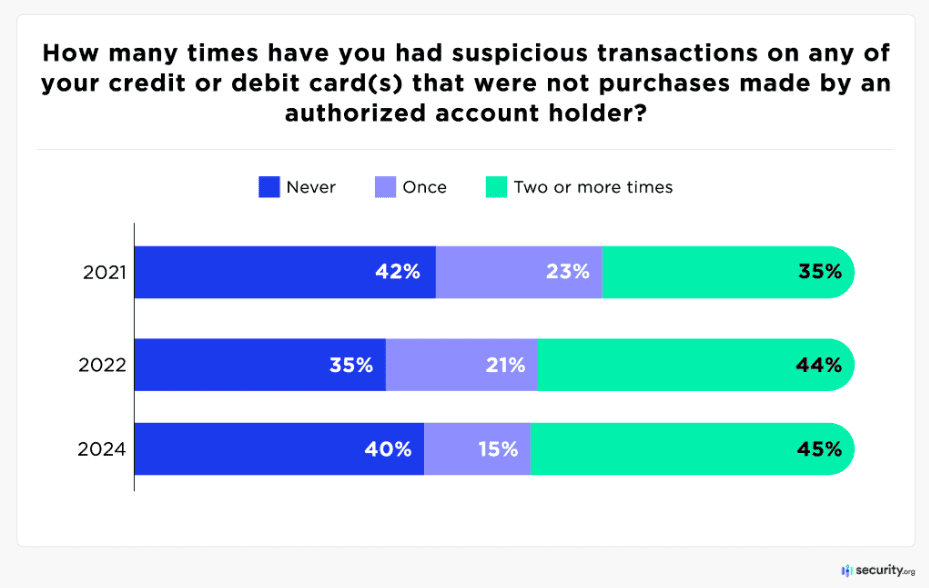

30. 60% of U.S. credit card holders have fallen victim to fraud, and 45% of them have been scammed multiple times.

31. Only 7% of those fraudulent charges were stolen or lost credit cards, while the rest came from scammers accessing personal data and account info remotely.

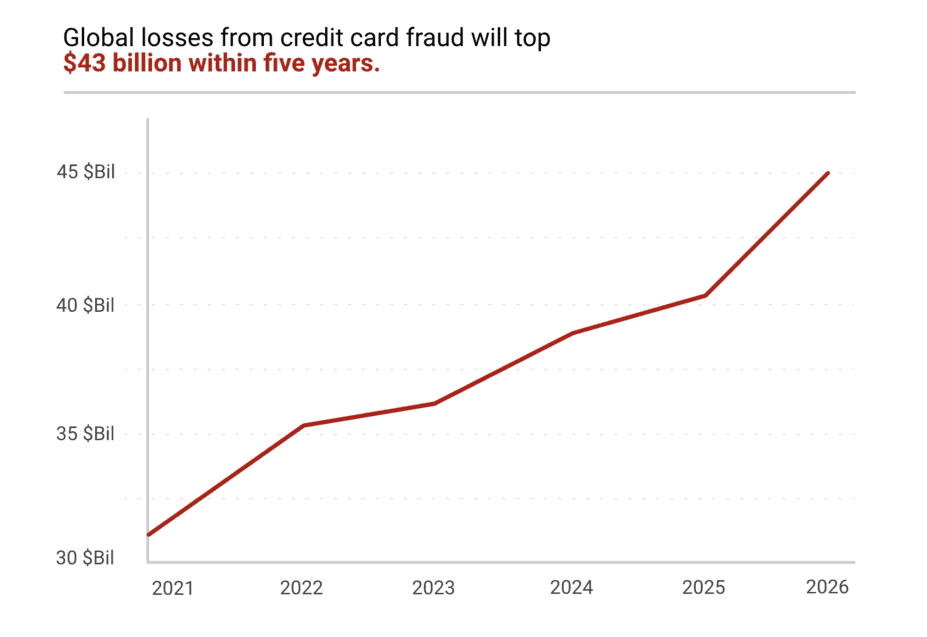

32. Global credit card fraud is projected to hit $43 billion by 2026. This is a huge jump from $9.84 billion in 2011 and $32.4 billion in 2021. If these predictions hold, it would mean a roughly 4.5x increase in just 15 years.

Global losses from credit card projections

33. Four out of five American adults now have at least one credit card, and three out of five cardholders have experienced unauthorized charges—an estimated 128 million victims. Of those, 75% reported having fallen victim to credit card fraud more than once.

Percentage of credit card holder experiencing fraud

Triangulation Fraud

Now this kind of fraud involves three parties: a buyer, a scammer, and a merchant.

The scammer posts a fake listing with a very low price on an eCommerce site that allows third-party sellers.

Once the buyer makes the purchase, the scammer uses stolen credentials to order a real version of the product and keeps all the money the buyer paid.

The seller then faces chargebacks for the fraudulent transaction, meaning they have to refund the money and pay extra fees.

The merchant may chat with the buyer to demand the product back, which could result in fraud charges.

34. Triangulation fraud is costing merchants big time, with the payments industry estimating losses between $660 million and $1 billion every month.

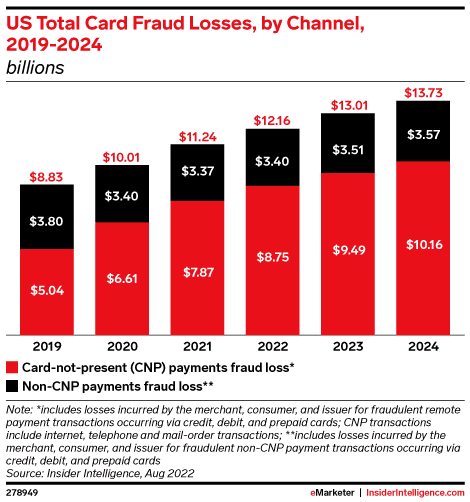

35. Experts also predict that by 2024, card-not-present (CNP) fraud, which includes triangulation fraud, will lead to over $10 billion in losses in the United States alone. That would make up 74% of all fraud cases.

US total card fraud loss by channel (2024)

Chargeback Fraud (Friendly Fraud)

Chargeback fraud (aka friendly fraud) happens when a customer buys something with a credit card, gets the products or services, and then disputes the charge with their credit card firm to claim a refund.

It’s often called “friendly” because the customer may not mean harm but disputes the charge for unfair or invalid reasons.

36. By 2024, eCommerce losses from online payment fraud are expected to top $25 billion annually, as per Juniper Research.

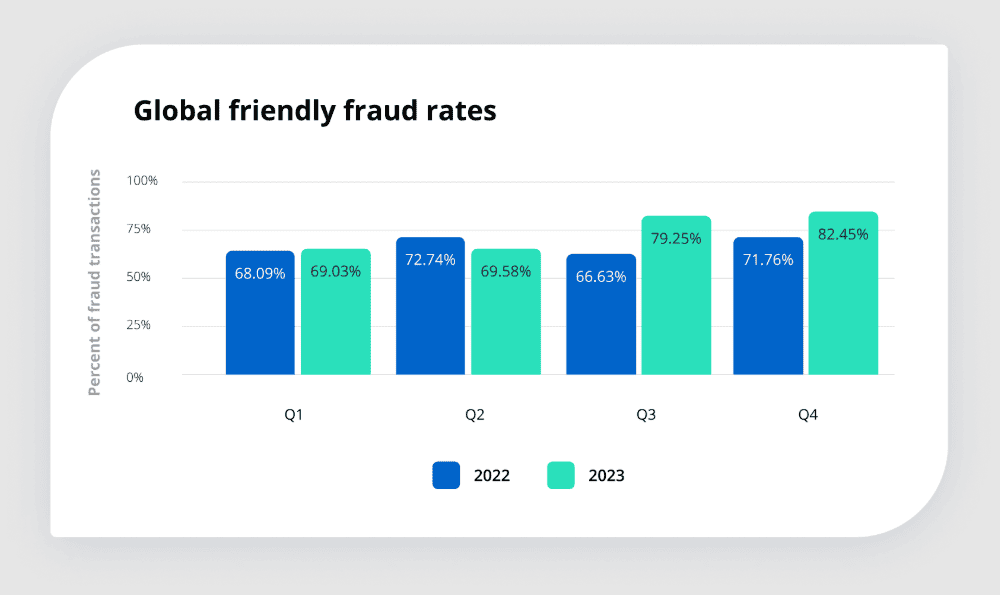

37. One of the most common fraud types is first-party misuse, also famous as “friendly fraud” or chargeback fraud. In 2022, this type of fraud affected 34% of eCommerce merchants worldwide.

Global friendly fraud rates (2022 vs 2023)

38. 18% of all eCommerce fraud disputes were due to first-party misuse (that’s friendly fraud). Merchants end up spending around $35 to manage fraud for every $100 in friendly fraud disputes.

39. While some chargebacks happen because of confusion, mistakes, or customer dissatisfaction, 58% of eCommerce merchants believe customers mainly try to get free products when committing friendly fraud.

Account Takeover (ATO)

Account takeover fraud happens when a scammer gets access to someone’s online account, like a bank or email account, by stealing all their login details through phishing or some other tricks.

40. The top five attacks on eCommerce sites include account takeover (ATO) at 29.8%, bot imposters at 24.1%, SQL injection (SQLI) at 8.2%, cross-site scripting (XSS) at 8.7%, and backdoor files at 6.4%. The “other” category makes up 22.8% of attacks.

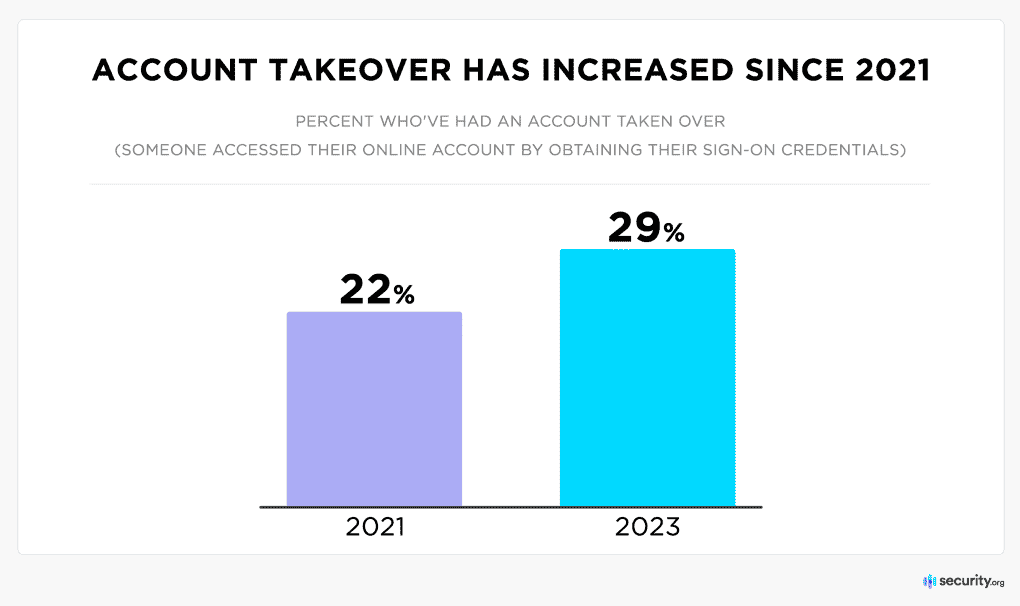

41. In 2023, about 29% of people experienced account takeover, up from 22% in 2021—roughly 77 million adults. Business or work account takeovers also saw an increase.

Account Takeover fraud has increased over the years

42. According to Security.org, over 24 million households have fallen victim to ATO, with the average financial loss per case around $12,000.

43. Javelin’s 2022 report found that $11.4 billion was lost to account takeover fraud.

44. The frequency of ATO attacks skyrocketed by 307% between 2019 and 2021, especially during the pandemic when more new accounts were created across different platforms.

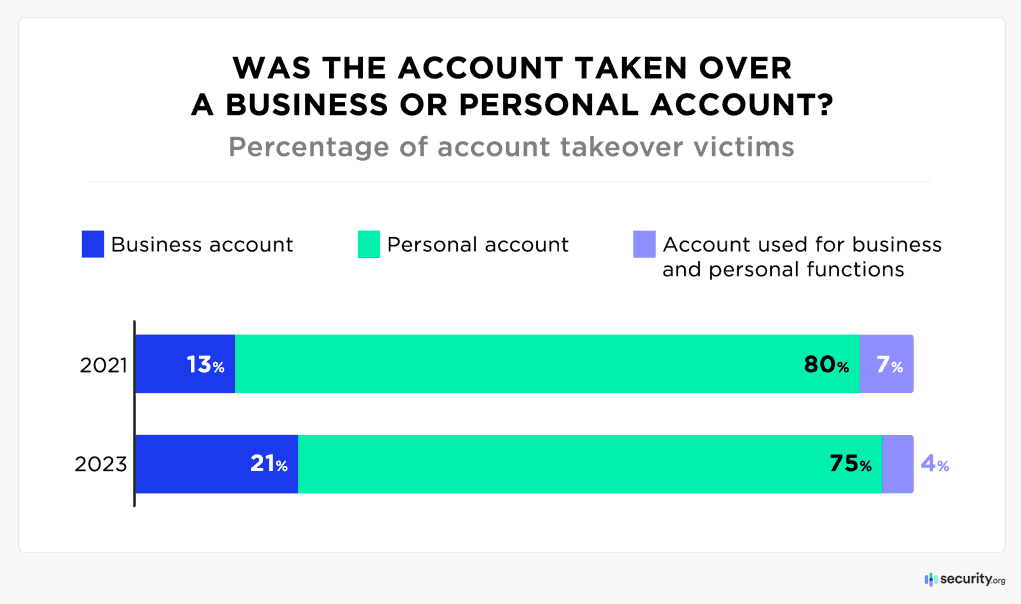

45. While most ATO victims had personal accounts breached, 21% of victims had their work or business accounts taken over—up from 13% in 2021.

Type of account taken over by fraud

Identity Theft

Identity theft happens when somebody takes all your personal information without permission and then uses it to carry out eCommerce fraud.

This can involve stolen details like credit card numbers, addresses, bank account information, or even insurance data.

Once the thief gets all this information, they can commit fraud while pretending to be the account holder.

46. In 2022, the Federal Trade Commission’s Consumer Sentinel Network Data Book reported that identity theft made up about 21.5% of all fraud cases, highlighting its growing threat to online retailers.

47. Out of all the 5.7 million fraud cases reported to the FTC, 1.4 million (25%) were specifically related to identity theft. The FTC separates identity theft into its own category, distinct from other types of fraud.

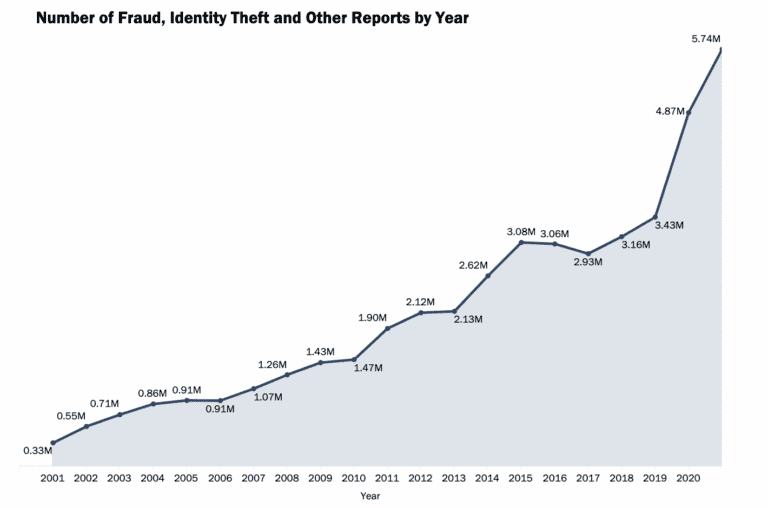

Number of identity theft reports by year

48. The number of identity theft cases in the U.S. is nearly three times higher than in other countries. Around 33% of Americans have experienced some form of identity theft at least once.

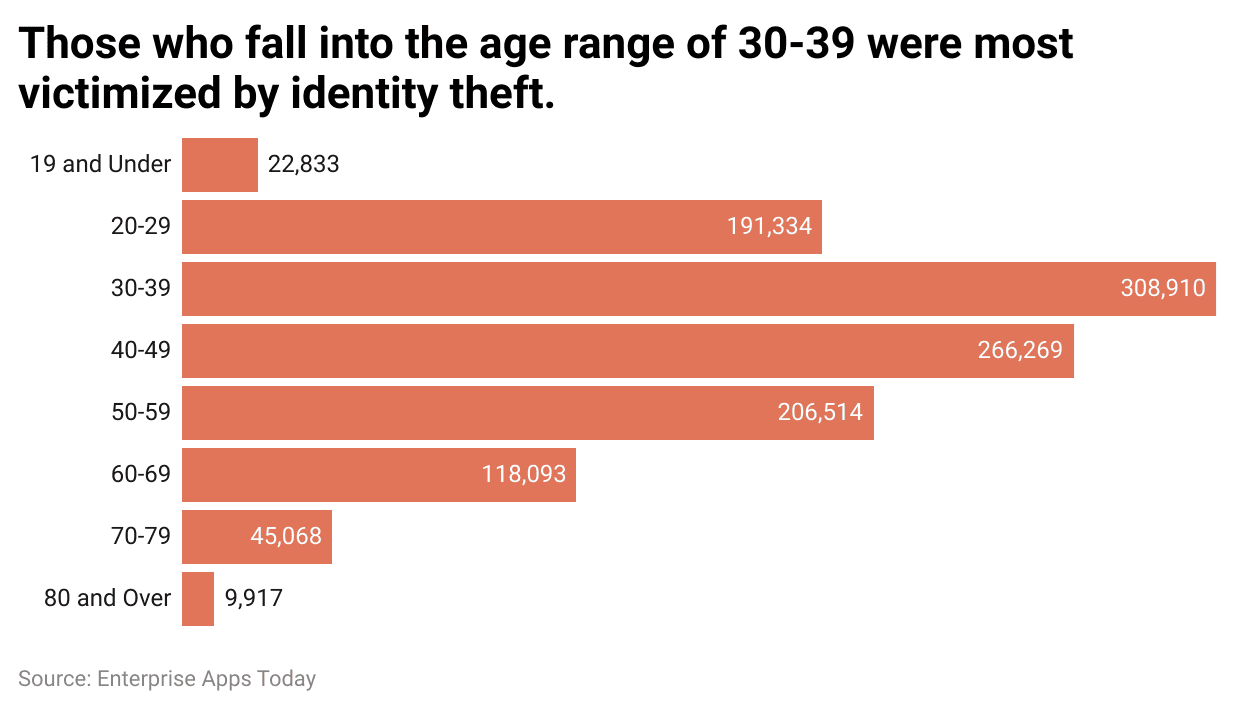

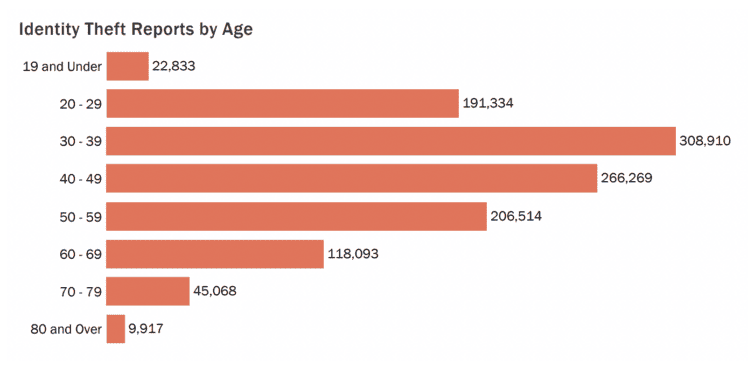

49. People aged 30-39 are the most commonly targeted group for identity theft. Over the past decade, the total number of fraud and identity theft cases has nearly tripled.

Identity theft reports by age

50. In Europe, one in five people faced identity theft between 2020 and 2022, with identity theft being the second most common type of fraud in the region, according to Finanso.

eCommerce Fraud Prevention Stats

The huge financial losses from fraud really show the need for strong security measures. Unfortunately, not many businesses are putting enough money into fraud prevention and protection.

Here are some key eCommerce fraud stats that reveal how much companies are investing in preventive measures and what methods are proving most effective in fighting eCommerce fraud:

51. 75% of eCommerce companies plan to boost their fraud prevention budgets in the next year, with 20% aiming for an increase of at least 20%. However, 5% of companies said they’ll reduce their budget.

52. 61% of eCommerce merchants believe two-factor authentication is the best way to prevent fraud. 53% of merchants think device ID solutions are the most effective, while 45% and 40% find rules and behavioral biometrics to be highly effective.

53. 63% of eCommerce businesses plan to reduce or eliminate manual screening of orders. Currently, eCommerce companies manually screen about 19% of orders for fraud, and 15% of those screened orders are found to be fraudulent, making up 3% of all orders.

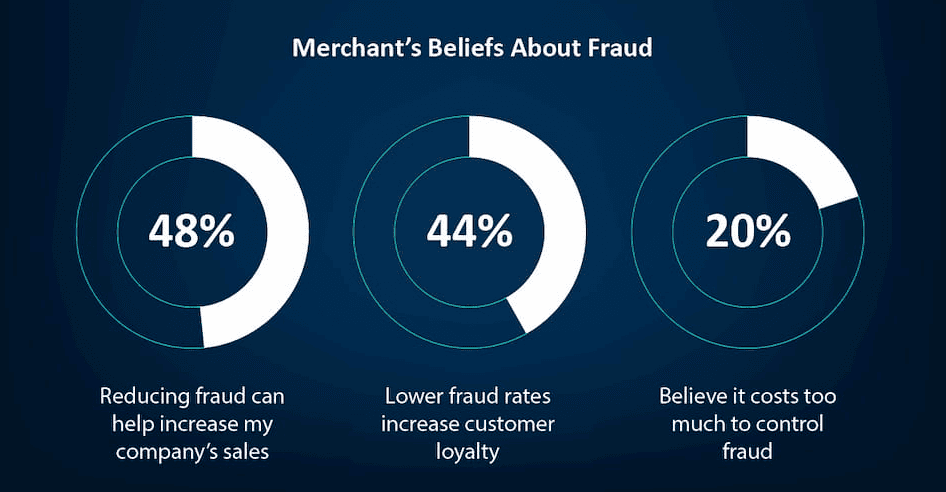

Merchant’s beliefs about fraud prevention

54. Around 80% of merchants use outsourced tools for fraud prevention, as in-house solutions are more expensive to maintain. Larger businesses prefer outsourced options for this reason.

55. 59% of eCommerce companies use CAPTCHAs to stop account takeover fraud, with 46% using additional bot detection tools, 26% using behavioral biometrics, and 38% relying on two-factor authentication.

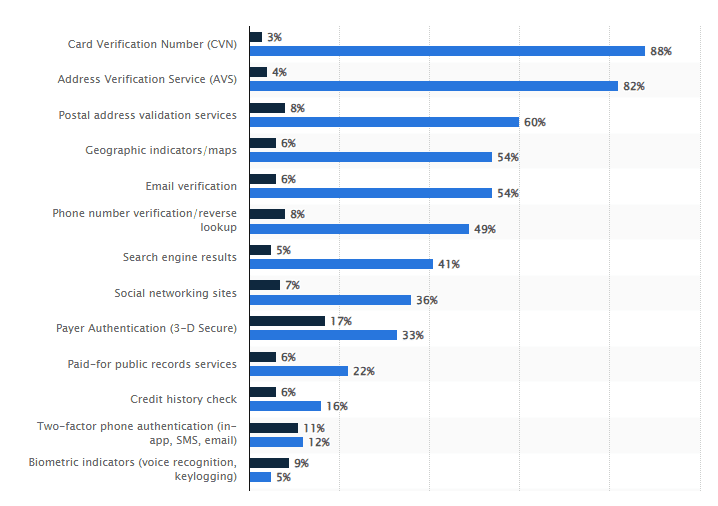

56. The most commonly used fraud detection tools are card verification numbers (CVN) at 88%, address verification services (AVS) at 82%, postal address validation at 60%, geographic indicators/maps at 54%, email verification at 54%, and phone number verification/reverse lookup at 49%.

Most-adopted fraud detection tools in the US and Canada

57. 42% of businesses say digital fraud is slowing their innovation and expansion into new digital channels, but only 34% of retailers are investing in fraud prevention.

58. Companies with fraud prevention programs saved 42% in fraud attack response costs and 17% in remedy costs compared to those without such programs.

eCommerce Fraud Consumer Stats

Attacks like account takeovers affect customers just as it affects vendors. But the thing is, some consumers play a role in the fraud issue through tactics like friendly fraud, including return abuse and policy violations.

These eCommerce fraud stats talk about the fraud issue from the consumer’s perspective.

59. A recent survey by Signifyd found that 25% of eCommerce shoppers have engaged in some form of policy fraud. Here’s a breakdown:

- 25% asked for a refund but kept the product

- 24% returned a another item than what they bought

- 22% lied about receiving a subpar product

- 21% claimed an order didn’t arrive

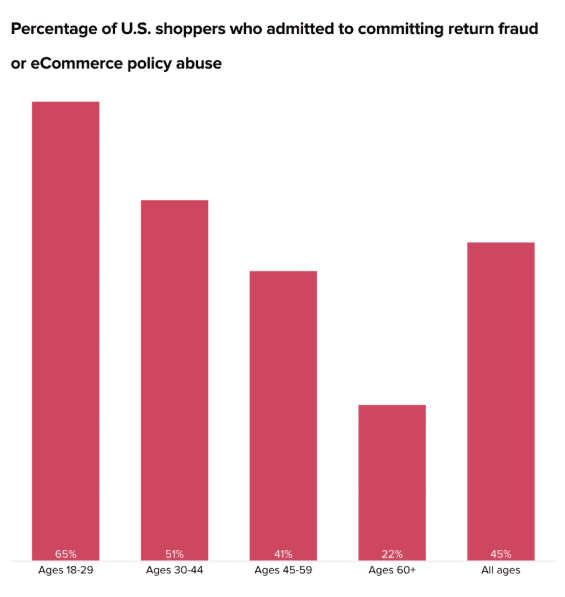

60. Riskified surveyed 1,000 U.S. eCommerce shoppers about return fraud and other policy abuses. Of the 45% who admitted to one or more actions, only 39% realized their actions were fraudulent.

Percentage of US shoppers who admitted to committing fraud

61. According to the BBB Scam Tracker, online shopping scams accounted for 30% of all online scams in 2022. Of these, 71.6% led to financial losses for the victims.

62. For many, payment fraud is a recurring issue. Among those who have experienced fraud, 62% were targeted 2-4 times.

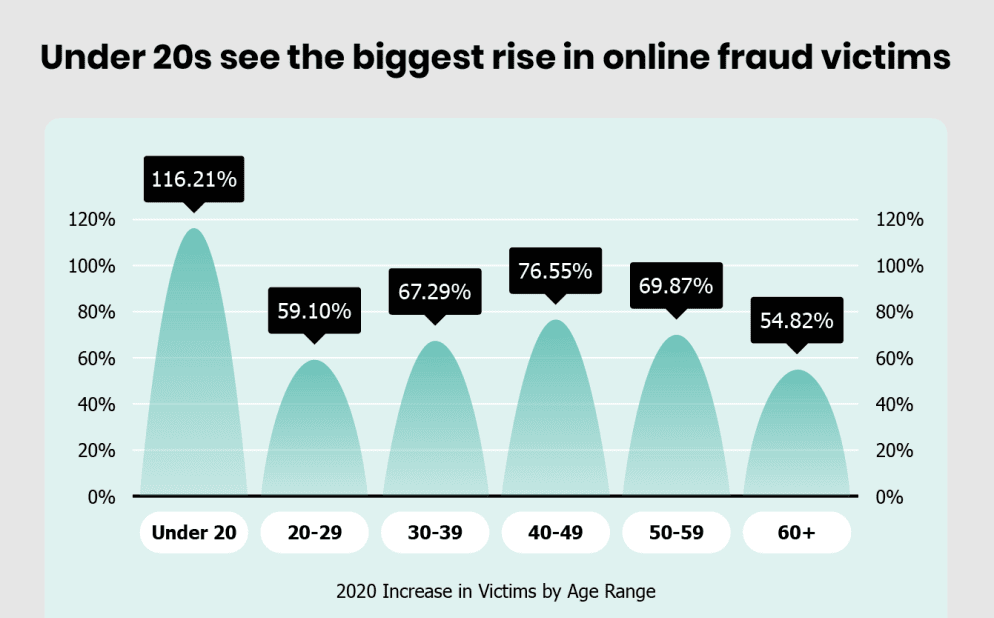

63. Elder Millennials and younger Gen Xers are the most vulnerable to online payment scams, with 77.3% at risk and 22.3% exposed to fraud. However, Gen Z (ages 18-24) reported the highest median loss, at $156.

Younger generations see the biggest rise in online fraud

64. Women reported 68.4% of online purchase scams in 2022, compared to 31.6% by men. Despite facing more scams, women lost less money, with a median loss of $100, while men lost $168.

65. 43% of eCommerce shoppers have fallen victim to payment fraud, and over half have experienced it more than once.

66. In a survey of U.S. and UK consumers, 80% said they’d made an online purchase in the past three months. However, 21% worry about entering their card details every time, and 31% express concern every time they shop online.

67. Consumers are split on who’s responsible for protecting against fraud: 57% of UK respondents said it’s their responsibility, not the bank’s, and 51% of U.S. consumers agreed.

Conclusion

As more people shop online each year, the risk of eCommerce fraud rises. With the growth of the eCommerce market, fraudsters are becoming more active than before.

For online businesses, understanding the risks and investing in the best fraud prevention tools can help protect profits and improve revenue.

Can eCommerce companies completely eliminate fraud? Likely not.

But by using technology to confirm customer identities and taking steps to prevent fraudulent returns and refunds, merchants can reduce the amount of revenue lost to these scams.